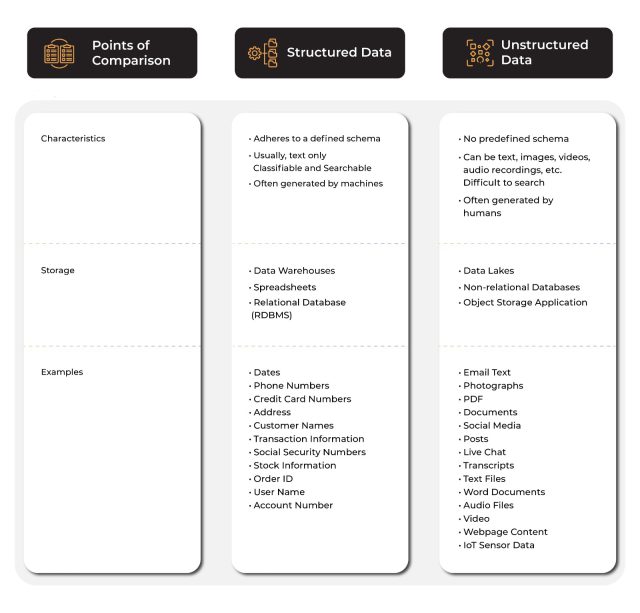

Documents are integral to key business processes, and enterprises have traditionally relied on knowledge workers to manually process documents or use fragmented automation tools/scripts. Research indicates that approximately 80% to 90% of the data generated and collected by companies is unstructured, lacking clear organization or formatting. This unstructured data, often referred to as “dark data,” presents a challenge as machines struggle to read or understand it due to the absence of identifiable patterns.

Within this untapped data lies transformative potential. While structured data provides insights into what is happening, unstructured data reveals why. It plays a crucial role in driving predictive capabilities, end-to-end automation, and the advancement of commercialized AI.

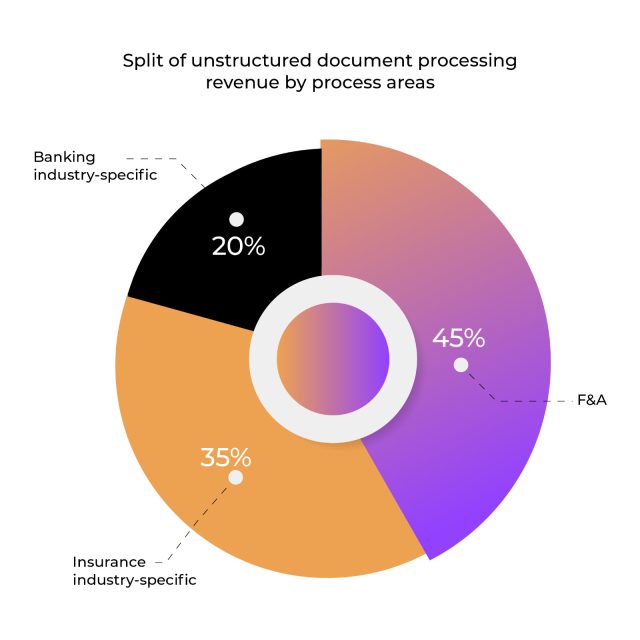

Among the various functions, Finance and Accounting contributes the highest revenue in processing unstructured data, i.e. 45%, which indicates the need to process unstructured data efficiently in the Finance and Accounting function.

But there is a problem…

In most organizations, manual effort is often required to parse and capture data from unstructured documents for further processing or deriving actionable insights. These manual processes are time-consuming and error-prone, and hence impact processing time and associated costs.

To address these challenges, many organizations have implemented their own solutions, relying on internal legacy applications for data entry. However, these applications often suffer from poor user experience, slow performance, and lengthy update cycles, negatively impacting employee experience. This impact is particularly pronounced in customer-facing processes, where longer turnaround times also affect the customer experience.

Traditional capture solutions recognize printed characters and convert images into machine-readable text. While they help solve the data capture problem, they have their own challenges, such as:

Due to the limitations of traditional capture solutions, which are ill-suited for semi-structured and unstructured documents, a significant portion of the document volume remains unprocessed. The inability to convert documents into a structured format restricts the value of automation tools like RPA, which require data in a structured and defined format for subsequent task automation. As a result, document-centric processes fall outside the scope of automation initiatives, leading to limited value realization.

So, how can enterprises address the processing of unstructured data?

These challenges have given rise to AI-enabled document processing solutions, known as IDP solutions. These solutions extract relevant data from documents and convert it into a structured format that can be easily fed into downstream applications such as Enterprise Resource Planning (ERP) and other transactional systems. IDP solutions can automate the processing of various documents, offering greater speed and accuracy compared to traditional approaches.

The Role of IDP in Processing Unstructured Data

IDP refers to the use of software products or solutions to capture data from documents (such as emails, text, PDFs, and scanned documents), understand the intent, categorize, and extract relevant data for further processing.

Through intelligent algorithms, IDP accurately captures essential information from documents, such as vendor details, invoice amounts, payment terms, and transaction dates. The extracted data is transformed into a structured format, facilitating integration with financial systems and databases. This structured data enables organizations to streamline accounts payable, accounts receivable, and financial reporting processes. It also allows for better analysis, forecasting, and decision-making by providing comprehensive and organized financial insights.

By employing IDP in the Finance and Accounting function, organizations can achieve greater efficiency, reduce manual errors, and improve compliance. It saves valuable time and resources that would otherwise be spent on manual data entry and extraction. Moreover, IDP enhances data accuracy and auditability, enabling organizations to gain deeper insights into financial trends and patterns.

Selecting the Best IDP Solution for Your Business

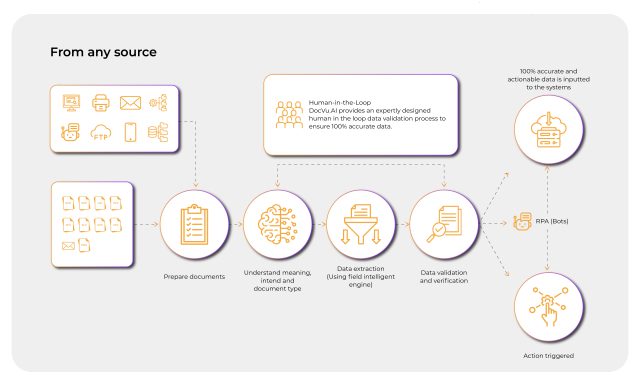

Enter DocVu.AI. As a leading IDP solution, DocVu.AI revolutionizes the way organizations handle unstructured data. By seamlessly integrating into Finance and Accounting workflows, DocVu.AI offers a comprehensive suite of features designed to capture, categorize, and extract relevant data from a wide range of documents, including emails, text files, PDFs, and scanned documents.

With advanced AI capabilities, DocVu.AI simplifies the extraction of actionable data from various unstructured documents such as invoices, receipts, financial statements, and contracts. It goes beyond simple optical character recognition (OCR) to understand the intent of the content and categorize and extract relevant data with remarkable accuracy.

End to End Automated IDP Workflow

The platform employs intelligent algorithms to identify and capture essential information from documents, including critical financial details like vendor names, invoice amounts, payment terms, and transaction dates. This eliminates the need for manual data entry and significantly reduces errors, saving valuable time and resources for finance and accounting professionals.

DocVu.AI then transforms the extracted data into a structured format that seamlessly integrates with financial systems and databases. This structured data can be easily processed and analyzed, enabling organizations to automate accounts payable and accounts receivable processes, generate accurate financial reports, and make informed decisions based on comprehensive insights.

By utilizing DocVu.AI, the Finance and Accounting function can enhance efficiency, improve data accuracy, and ensure compliance with regulations. The platform empowers finance professionals to rapidly extract actionable data from unstructured documents, enabling faster decision-making, improved forecasting, and a deeper understanding of financial trends and patterns.

With its advanced capabilities and user-friendly interface, DocVu.AI is a game-changer for the Finance and Accounting function, streamlining processes, optimizing resource utilization, and unlocking the true value from unstructured data.

Why wait then?

Discover the transformative capabilities of DocVu.AI and unlock the value of unstructured data in your Finance and Accounting processes. Schedule a demo or contact us to learn more about how DocVu.AI can revolutionize your document processing.