QUALITY CHECKS AND AUDIT

Enhance Data Quality with Automated Checks and Post-Closing QC

Improve data quality across your loans and mortgage processes.

Time-consuming processes delaying quality and compliance adherence?

Quality checks still consist of manual paper pushing and are not adaptable with processing systems due to multiple formats and sources. Further, quality requirements like MSR and regulatory necessity like HMDA compliance needs thorough validation of the processed documents.

THE SOLUTION

Build reliability and adhere to regulatory policies with confidence

DocVu.AI’s technology streamlines the quality checks and compliance adherence by offering faster document processing, better data extraction, and accurate indexing of the documents. It offers unmatched speed and convenience in checking the mandatory requirements of the entire process and simplifies pre and post closure operations.

Applications

DocVu.AI Capabilities

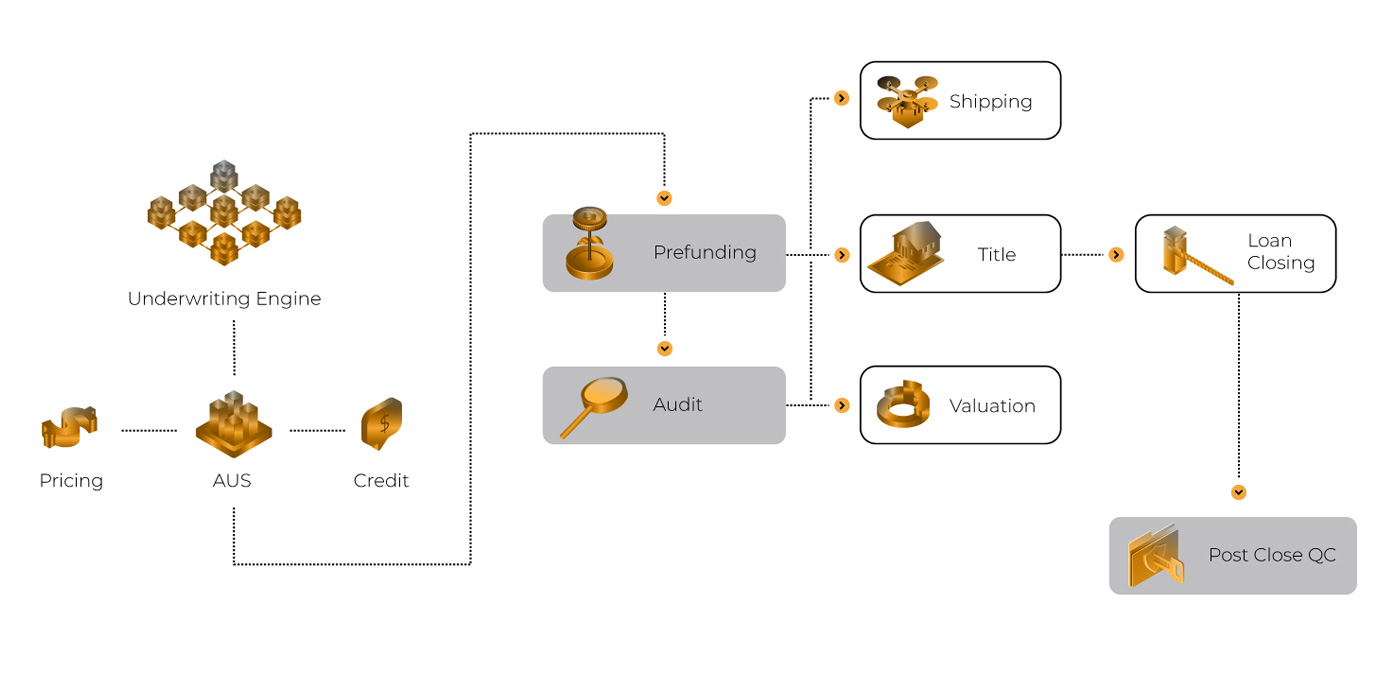

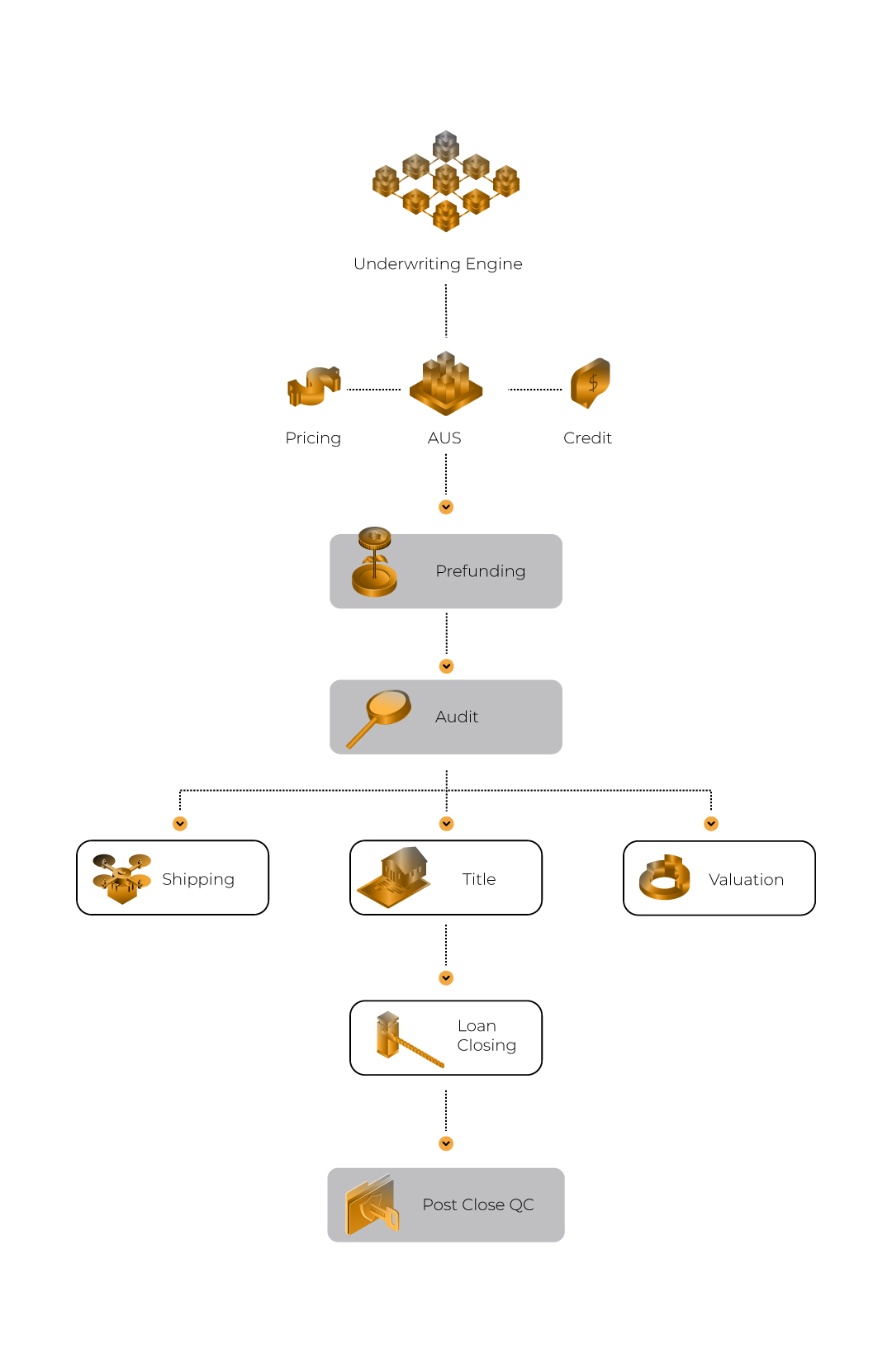

Pre-fund QC and Post Close QC

Due diligence

HMDA Reporting

Maximize mortgage approvals with a document processing automation solution, DocVu.AI.

Improve your document processing speed and enhance your data extraction efficiency using DocVu.AI

Case Studies

Stay informed with the latest on the Industries we work with and news updates from our company.

How DocVu.AI Revolutionized ‘Order to Cash Process’ for a Leading Pharma Chain

Please submit this form to download Case Study

Bank in North America to Achieve Excellence in Post-Close Audit using IDP solutions

Please submit this form to download Case Study

Knowledge Centre

Keep updated with our resources on mortgage industry and the latest company updates

Top 6 Pain Points in Mortgage Document Management and How DMSVu Fixes Them

In mortgage lending, document management has become a quiet drag on performance. From intake to audit, teams deal with scattered

Beyond Spreadsheets: Why Your Finance Department Needs an AI-Powered Document Strategy in 2025

Introduction Reporting delays, compliance risks, and operational bottlenecks still plague finance departments, not because the data is unavailable, but because

7 Common Financial Document Management Challenges and How DocVu.AI Addresses Them

There’s a moment every finance associate dreads the last-minute email asking for a document that should’ve been easy to find

Offer more mortgages to your customers

Want to know how DocVu.AI makes mortgage document processing efficient? Get in touch with us!

Frequently Asked Questions

Traditional quality checks are manual, time-consuming, and not adaptable to various formats, impacting efficiency and compliance.

DocVu.AI automates document processing, data extraction, and indexing, ensuring faster, more accurate quality checks and regulatory compliance.

Applications include pre-fund and post-close QC, due diligence, and HMDA reporting, ensuring thorough validation and compliance.

DocVu.AI validates MSR requirements, facilitating seamless processing for secondary market service providers.

DocVu.AI helps maintain HMDA compliance, reducing the risk of customer defaults and bad loans.

DocVu.AI maximizes mortgage approvals by automating document processing, enhancing data extraction efficiency, and ensuring accurate data handling.

DocVu.AI follows the latest cybersecurity protocols to protect customer data and prevent misuse by hackers or malicious websites.