Introduction

Reporting delays, compliance risks, and operational bottlenecks still plague finance departments, not because the data is unavailable, but because the documents behind the data are disorganized, inconsistent, and difficult to manage.

For many U.S.-based CFOs and finance leaders, this translates into prolonged monthly closes, disjointed audit preparation, and constant follow-ups for missing or misfiled records. The root cause? An over reliance on spreadsheets and manual document handling in a business world that demands speed, transparency, and control.

Traditional document workflows, built around outdated methods, cannot scale with growing organizational complexity. As finance leaders look to modernize operations, the shift toward an AI-powered document strategy becomes not just beneficial but essential.

Why Finance Teams Still Struggle with Documents

While finance functions have evolved in terms of analytics and systems, document workflows remain surprisingly manual. The problem is not the volume of documents, but the way they are handled; fragmented, redundant, and devoid of system intelligence.

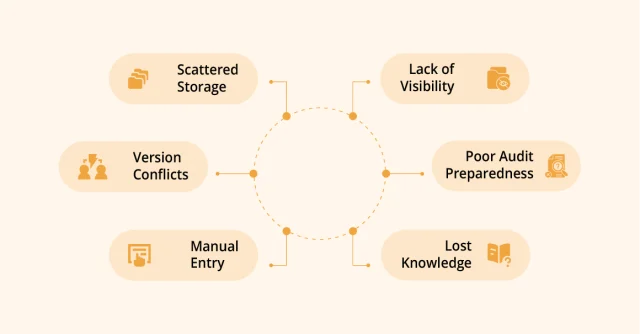

Common Document Challenges in Finance:

Scattered Storage: Files are stored across email inboxes, desktops, shared drives, or even in paper form. Finding the right version is time-consuming and error-prone.

Version Conflicts: Multiple team members often work on different versions of the same file, leading to inconsistencies in reporting and reconciliation.

Manual Entry: Paper-based invoices, receipts, and contracts are re-keyed into systems manually, increasing the risk of errors and delays.

Lack of Visibility: Without a live system tracking document status, teams operate in silos. Approvals get delayed, and compliance checks fall through the cracks.

Poor Audit Preparedness: When audit season arrives, teams scramble to compile documents, verify actions, and fill in missing gaps, often under intense time pressure.

Lost Knowledge: When employees leave or roles shift, institutional knowledge about where documents are stored often disappears with them.

These friction points don’t just slow processes, they reduce confidence in financial accuracy and expose organizations to compliance risks.

The Case for an AI-Powered Document Strategy

Unlike traditional document management approaches, an AI-powered document strategy integrates intelligence into the entire document lifecycle from capture to classification, validation, and retrieval.

This strategy ensures that every document supporting a financial process is structured, searchable, and synchronized with the systems finance teams already use.

By removing the manual burden of sorting, entering, and tracking documents, finance professionals can shift their focus from chasing paperwork to delivering strategic insight.

How DocVu.AI Transforms Document Management for Finance and Accounting

DocVu.AI is purpose-built to address the exact pain points finance and accounting teams face in managing their document ecosystem. It brings structure, intelligence, and speed to processes that were once heavily reliant on human effort and ad hoc solutions.

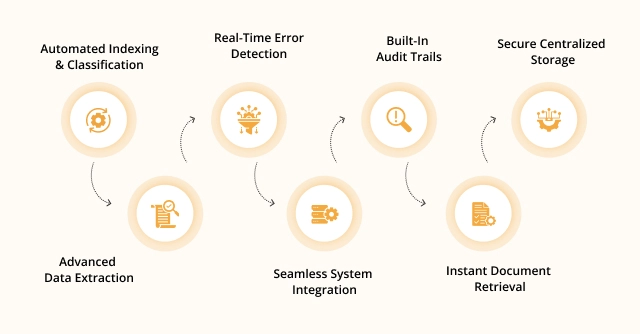

Key Capabilities of DocVu.AI:

- Automated Indexing & Classification

DocVu.AI automatically identifies and organizes incoming documents using preconfigured templates. Whether it’s a vendor invoice, expense report, or contract, the platform ensures it is indexed correctly from the moment it enters the system. - Advanced Data Extraction Without Templates

Using intelligent OCR and machine learning, DocVu.AI extracts data from both structured and unstructured documents including scanned files and handwritten content without requiring predefined templates. - Real-Time Error Detection

The platform flags inconsistencies, missing information, or misfiled documents before they reach core systems. This proactive validation helps prevent errors from cascading downstream. - Seamless System Integration

DocVu.AI integrates smoothly with ERP and accounting platforms such as Encompass, Lending QB, and custom financial systems. Data flows directly into your existing infrastructure, reducing the need for duplicate entry and manual reconciliation. - Built-In Audit Trails

Every action taken on a document upload, review, validation, approval is tracked and logged. This creates a verifiable, time stamped audit trail that supports compliance, reduces audit stress, and ensures accountability. - Secure Centralized Storage

With cloud-native architecture and role based access control, DocVu.AI ensures documents are stored securely and accessed only by authorized users. - Instant Document Retrieval

Whether searching by vendor, keyword, or document type, finance teams can locate critical documents instantly. This eliminates time lost to digging through folders and email chains.

Built for Critical Use Cases in Finance

DocVu.AI supports high-impact workflows across finance and accounting functions:

- Accounts Payable: Automate invoice intake, validation, and exception handling.

- Accounts Receivable: Link incoming payments to supporting documentation for faster reconciliation.

- Month-End Close: Ensure documents are validated, traceable, and accounted for at every step.

- Audit & Compliance: Maintain centralized records with audit-ready documentation.

- Vendor Management: Store contracts, tax forms, and correspondence in one place.

By aligning with how finance operates, DocVu.AI enables a seamless experience in document management for finance and accounting.

Enabling the Future with Financial Automation Solutions

DocVu.AI is more than a document tool it’s an enabler of strategic automation. By embedding document intelligence into daily workflows, it becomes part of a broader suite of financial automation solutions that empower teams to deliver real time, reliable insights.

This shift reduces reliance on human intervention for routine tasks, freeing finance professionals to focus on risk management, forecasting, and business strategy.

Conclusion

The reliance on spreadsheets and disconnected document systems is holding finance teams back. In an era that demands precision, agility, and compliance, those tools are no longer enough.

DocVu.AI delivers the visibility, structure, and automation finance teams need to lead with confidence. By adopting an AI-powered document strategy, teams reduce friction, increase control, and elevate their role within the organization.

Frequently Asked Questions

DocVu.AI processes a wide range of document formats-including scanned, digital, and handwritten files-using intelligent recognition and classification tools to ensure consistent and accurate handling.

Yes. DocVu.AI integrates with common ERP and finance platforms, including Encompass, Lending QB, and custom systems, using secure APIs and data connectors.

DocVu.AI supports key processes such as accounts payable, accounts receivable, audit preparation, expense management, and month-end closing, improving speed and accuracy.

All document actions are tracked through built-in audit trails. Documents are centralized, secured, and available for quick retrieval, making compliance audits more efficient and less stressful.