In 2026, AI in Credit Unions is no longer a future discussion or an innovation lab topic. It has quietly become part of how lending teams manage volume, risk, and rising member expectations. What has changed is not just adoption, but intent.

Credit unions are moving away from isolated automation and toward Intelligent Lending Automation that helps teams act earlier, reduce uncertainty, and make consistent decisions without sacrificing their relationship-driven approach. The result is lending that moves faster, feels more predictable, and builds trust with members rather than testing it.

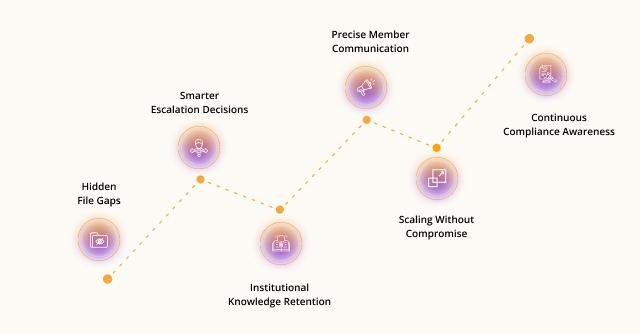

The following six areas reflect where AI is making a meaningful difference in lending today.

Hidden File Gaps

Most lending delays are not caused by missing documents. They are caused by files that look complete but are not ready. A form might be present, but outdated. A supporting document might exist, but not align with the rest of the file. AI helps credit unions detect these hidden gaps while the application is still moving, not days later during final checks. This reduces late surprises and shortens the time between approval and funding. By addressing issues earlier, credit unions reduce rework, funding delays, and internal friction.

Smarter Escalation Decisions

In many credit unions, escalation becomes the default response to uncertainty. This protects quality, but it also slows progress and consumes senior time. AI can help distinguish between normal variation and true risk by analyzing patterns across similar cases. This allows teams to escalate with confidence when needed and proceed without hesitation when they do not.

Institutional Knowledge Retention

Every credit union has experienced lenders who know where issues usually hide. That knowledge is built over years, but it is rarely documented fully. AI helps retain this institutional understanding by learning from historical reviews and outcomes. As teams change or volumes rise, this embedded knowledge supports consistency and helps newer staff make better decisions faster.

Precise Member Communication

Members do not want frequent updates. They want clarity. AI helps lending teams determine when communication is actually necessary and what information is missing. Instead of generic reminders or repeated follow-ups, messages become more specific and timely. This reduces frustration and reinforces trust, especially during longer or more complex lending journeys.

Scaling Without Compromise

Growth is a priority for many credit unions, but it often raises concern about losing the personal touch. With Lending Workflow Automation, complexity is handled behind the scenes. Lending teams can continue working in familiar ways while the system absorbs volume, routing decisions, and coordination. This allows credit unions to grow lending activity without changing how they serve members.

Continuous Compliance Awareness

Compliance challenges tend to surface late when they are hardest to fix. AI helps keep policy considerations active throughout the lending process instead of treating compliance as a final hurdle. As files evolve, checks are applied continuously, reducing last-minute corrections and audit pressure. This makes compliance more predictable for lending teams.

This approach aligns with how credit unions are using AI today. A recent report from America’s Credit Unions notes that institutions are applying AI to document handling and decision support to increase lending capacity while maintaining regulatory discipline.

The Way Forward

The most effective use of AI in Credit Unions today is not about doing more, but about doing things earlier and with greater confidence. When paired with thoughtful Document Automation, lending teams spend less time managing uncertainty and more time supporting members. The result is lending that feels faster, steadier, and easier to trust, without sacrificing the values that define credit unions.