Introduction: Why Speed Matters in Loan Processing

In today’s hyper- competitive digital lending landscape, speed and accuracy define borrower experience. Customers now expect loan approvals in days, not weeks – while lenders juggle hundreds of documents per loan file, including income proofs, KYC forms, credit reports, property papers, and compliance checklists.

Yet, many institutions still rely on manual document organization and search, where employees scan through folders, misnamed files, and outdated indexing systems.These inefficiencies directly slow down approvals, increase operational risk, and hurt customer trust.

This is where automated document indexing powered by AI transforms mortgage operations, enabling lenders to locate, verify, and process documents faster than ever before.

What Is Automated Document Indexing?

Document indexing is the process of tagging and organizing files so they can be easily searched,retrieved and understood.

In traditional systems, this requires human operators to manually label each document type —making it slow, inconsistent, and error-prone.

Automated document indexing, powered by AI and Intelligent Document Processing (IDP) platforms like DocVu.AI, eliminates these limitations using:

- OCR (Optical Character Recognition)

- NLP (Natural Language Processing)

- Machine learning-based document understanding

It automatically:

- Detect document types (e.g., pay slips, tax forms, loan applications)

- Extract key data fields (e.g., borrower name, loan number, PAN, property ID)

- Assign metadata and index tags automatically

- Enable instant search and navigation across loan files

The result? A unified, searchable repository where documents can be located and verified in seconds.

The Problem with Manual Document Search in Mortgage Workflows

Before automation, mortgage teams face three major bottlenecks:

- Time-Consuming Retrieval:

Locating a single missing document can take hours — especially when file names or folder structures are inconsistent. - Human Error:

Misfiled or mislabeled documents often lead to compliance delays or rework. - Lack of Visibility:

Without indexed metadata, lenders can’t easily track the status of each file or identify missing items.

When multiplied across hundreds or thousands of loans, these inefficiencies significantly slow down approvals and increase operational costs.

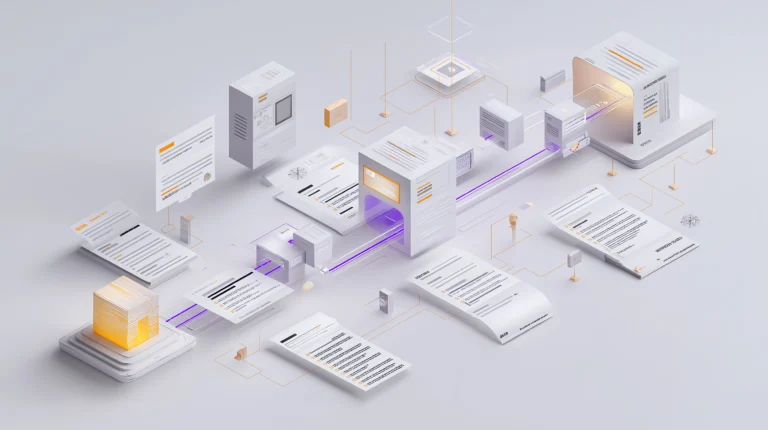

How Automated Indexing Solves These Challenges

Platforms like DocVu.AI automate the indexing process end-to-end, turning unstructured data into actionable, searchable information.

1. AI-Based Document Classification

DocVu.AI intelligently identifies document types — even if they vary in format, layout, or structure.

No predefined templates required. Whether it’s a scanned PDF, a handwritten form, or an image — the AI learns from context and classifies accordingly.

2. Metadata Tagging and Data Extraction

Each document is enriched with metadata — borrower details, document type, date, etc.

This metadata fuels powerful search capabilities, allowing users to find documents by keyword, ID, or even content fragments.

3. Smart Validation and Cross-Referencing

DocVu.AI validates indexed data against loan origination or CRM systems — ensuring accuracy and completeness before moving forward in the workflow.

4. Centralized Access and Navigation

With all indexed documents stored in a unified repository, lenders gain instant access and traceability across all cases — supporting faster audits and regulatory checks.

Real Impact: Faster Loan Processing and Happier Customers

Here’s what automated document indexing means for real-world lending teams:

| Impact Area | Manual Process | With Automated Indexing (DocVu.AI) |

|---|---|---|

| Document Search Time | 15–30 minutes per file | < 30 seconds |

| Document Accuracy | 80–85% (prone to errors) | 99%+ accuracy |

| Loan Approval Turnaround | 7–10 days | 2–3 days |

| Compliance Readiness | Reactive | Real-time dashboard visibility |

By streamlining retrieval and navigation, lenders can cut down approval times by up to 70%, reduce rework, and deliver a frictionless borrower experience.

Compliance and Audit Benefits

Beyond speed, automation also improves compliance and audit readiness.

Indexed documents can be:

- Tracked with version control and audit trails

- Flagged for missing or outdated content

- Automatically validated against internal policy and regulatory standards

This ensures every loan file remains complete, compliant, and easily verifiable — a major advantage during audits or quality checks.

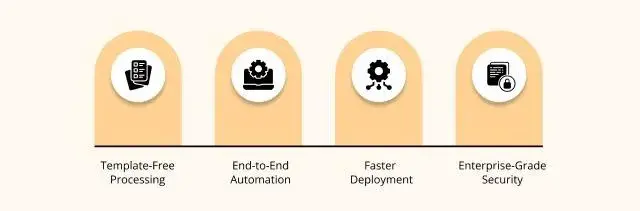

Why DocVu.AI Excels at Automated Indexing

DocVu.AI brings several advantages for lenders and financial institutions:

- Template-Free Processing: Works seamlessly across varied document formats.

- End-to-End Automation: From ingestion and classification to extraction, validation, and indexing.

- Faster Deployment (≤ 4 Weeks): Quick integration with LOS, CRM, and ERP systems.

- Enterprise-Grade Security: Ensures sensitive borrower data is always protected.

Whether managing a few thousand or millions of documents, DocVu.AI scales effortlessly to meet enterprise demands.

Conclusion: Building the Foundation for Digital Lending Efficiency

Automated document indexing is more than a convenience — it’s a strategic advantage.

By improving searchability, organization, and navigation, lenders gain speed, accuracy, and visibility — accelerating approvals and improving customer satisfaction.

For organizations looking to modernize loan operations, DocVu.AI provides the intelligent backbone to make document workflows faster, smarter, and more compliant.