Mortgage due diligence has always been about accuracy, but in 2025, it’s become a race against time. Every loan file now carries more data, more documentation, and higher scrutiny, yet the review process for most teams hasn’t evolved fast enough to match it. Manual checks slow decisions, increase costs, and leave too much room for error. The next chapter of due diligence is not about working harder; it’s about working smarter. In this blog, we’ll explore how innovations in underwriting document automation, mortgage compliance checks, and mortgage document validation are helping lenders move from manual review to intelligent risk assessment and how DocVu.AI is leading that shift.

As the industry pushes toward faster, more transparent lending, due diligence is facing its biggest shift yet. The following sections take a closer look at what’s shaping this change, the challenges, the role of automation, and how intelligent solutions like DocVu.AI are redefining what effective risk assessment looks like today.

1. Common Challenges in Mortgage Due Diligence

Despite its importance, mortgage due diligence remains one of the most time-consuming stages in the lending lifecycle. Teams often rely on manual document reviews, outdated templates, and disconnected systems that make it hard to track progress or verify data consistently. Small inconsistencies across borrower files can lead to delayed closings or missed compliance checkpoints. These inefficiencies add pressure on due diligence teams, who already operate within tight turnaround windows and growing audit demands.

2. Why Manual Due Diligence Increases Operational Risk

Adding more people to review loan files doesn’t necessarily improve accuracy; it often increases the chance of human error. When information is manually extracted and validated across hundreds of pages, even small oversights can multiply into larger operational risks. Duplicate entries, version mismatches, or missing signatures can easily slip through the cracks. Over time, these errors not only impact compliance but also the credibility of the due diligence process itself. To build trust and efficiency, lenders need systems that detect errors before they reach the final review.

3. The Role of Automation in Modern Mortgage Due Diligence

Automation is no longer just a convenience; it has become a necessity for managing due diligence at scale. Intelligent solutions now combine underwriting document automation, mortgage compliance checks, and mortgage document validation to create a faster, more reliable review process. By interpreting data instead of just reading it, automation helps identify exceptions in real time and routes them for human review. This balance between technology and human oversight ensures that due diligence teams focus on judgment-based decisions rather than repetitive data checks.

4. How DocVu.AI Transforms the Due Diligence Process

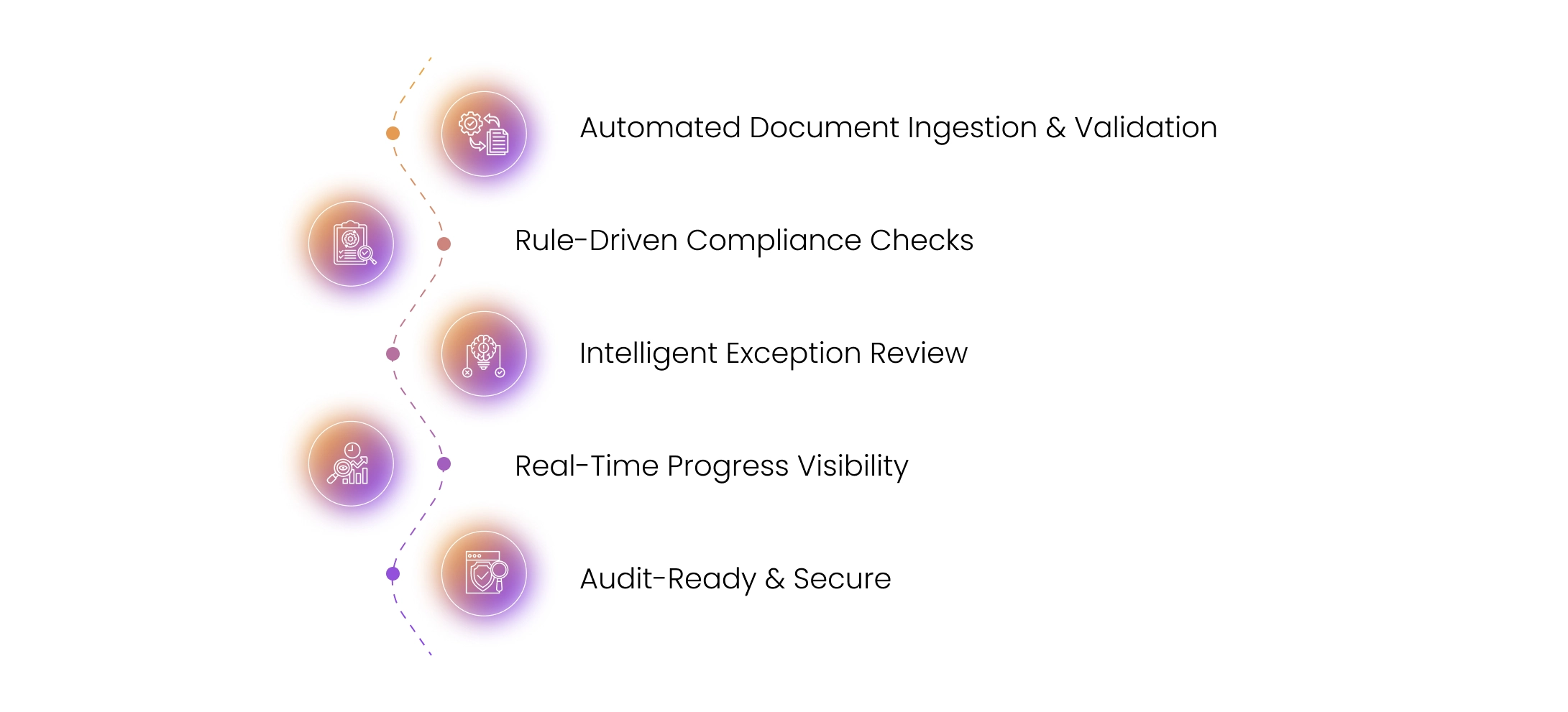

Automated Document Ingestion and Validation

DocVu.AI captures and validates information across multiple document types, eliminating the need for repetitive data entry and manual cross-checks.

Rule-Driven Compliance Checks

Its configurable rules engine automatically verifies each loan file against defined compliance standards, reducing the burden of manual verification.

Intelligent Exception Review

The platform flags anomalies instantly and routes them to reviewers for contextual validation, keeping human expertise where it adds the most value.

Real-Time Progress Visibility

Teams gain a clear view of every loan’s review stage through dashboards that track completion, exceptions, and pending approvals in one place.

Audit-Ready and Secure

Every activity is logged automatically, creating a full audit trail while ensuring data integrity and compliance with industry standards.

5. The Results: Faster, Smarter, and More Compliant Due Diligence

With DocVu.AI, due diligence becomes a data-driven process rather than a manual checklist. Lenders can review files faster, detect inconsistencies early, and maintain a higher standard of accuracy without increasing operational load. Automated insights help prioritize high-risk files, while built-in validation strengthens compliance and confidence across every review.

Mortgage due diligence no longer needs to be a bottleneck. With the right automation in place, lenders can combine speed and precision to deliver reviews that stand up to both market demands and regulatory scrutiny. Ready to see how? Request a demo.