In today’s fast-paced digital world, businesses face the constant pressure to optimize efficiency, reduce costs, and stay ahead of the competition. One of the most time-consuming challenges organizations face is document processing, a task traditionally dependent on manual effort. But with Intelligent Document Processing (IDP) powered by AI and Machine Learning (ML), companies can now automate this complex workflow end-to-end.

So, what exactly is holding teams back and what needs to change? Let’s break down six recurring pain points that continue to drain time, accuracy, and confidence across mortgage document management.

What is Intelligent Document Processing (IDP)?

Intelligent Document Processing (IDP) uses AI, ML, Natural Language Processing (NLP), and Computer Vision to extract, validate, and process data from structured, semi-structured, and unstructured documents. Unlike traditional Optical Character Recognition (OCR) tools, IDP solutions like DocVu.AI go beyond basic data capture by intelligently interpreting and validating document content.

Why Businesses Are Moving to AI-Based Document Processing

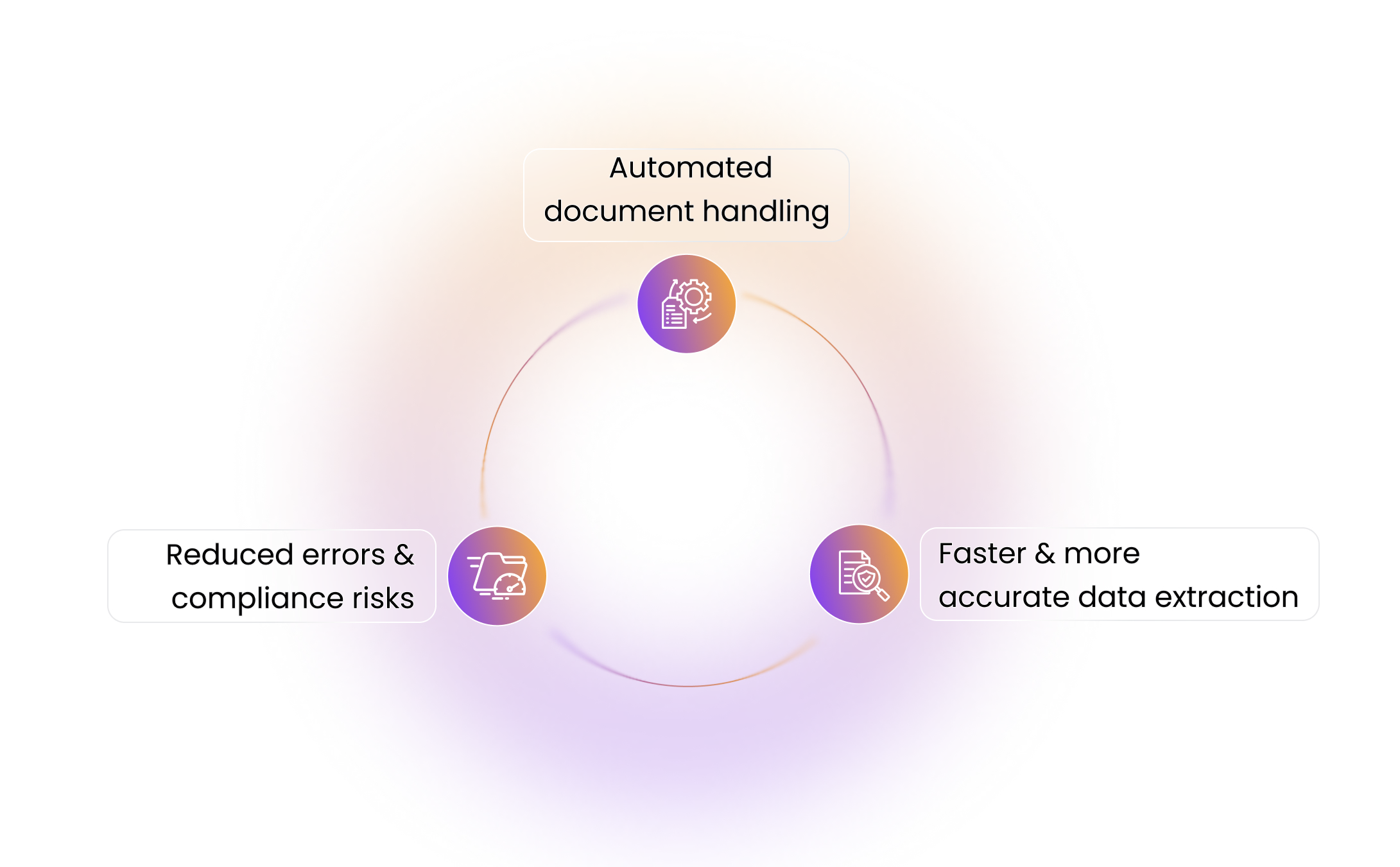

1. Automated Document Handling

DocVu.AI automates the capture, classification, and sorting of documents such as invoices, contracts, receipts, loan files, and onboarding forms, eliminating the need for manual entry.

2. Faster and More Accurate Data Extraction

By leveraging pre-trained AI models and pattern recognition, DocVu.AI extracts key information with greater accuracy and speed, ensuring scalable and reliable document automation.

3. Reduced Errors and Compliance Risks

AI-powered validation engines minimize human errors and flag inconsistencies. This improves compliance, especially in highly regulated industries like mortgage, insurance, and finance.

The Generative AI Advantage in Document Automation

DocVu.AI stands apart by integrating Generative AI capabilities into its platform. Here’s how it adds value:

- Understands new document formats and templates effortlessly

- Generates synthetic training data to improve model accuracy

- Triggers event-based workflows (e.g., notifications, approvals, audits)

- Enables decision-making automation for document-intensive workflows

Top Use Cases of Intelligent Document Processing with DocVu.AI

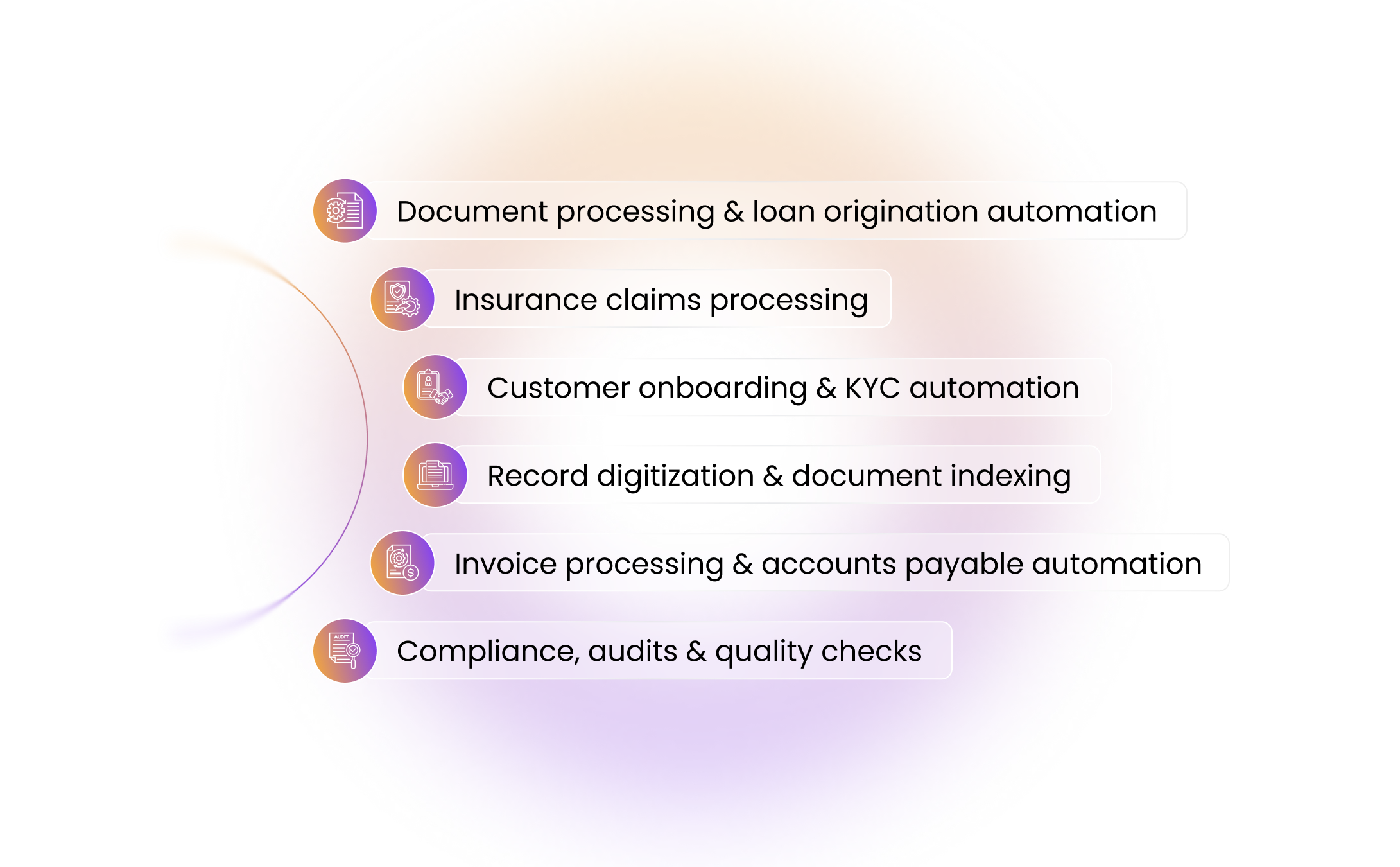

1. Mortgage Document Processing & Loan Origination Automation

Challenge: Mortgage lending involves large volumes of paperwork, income proof, ID verification, property documents, and credit reports often handled manually.

DocVu.AI’s Solution:

- Automates data extraction from mortgage applications

- Uses AI to validate W-2s, pay stubs, 1003 forms, and appraisals

- Speeds up underwriting and loan decision-making

- Ensures compliance with complete audit trails

2. Insurance Claims Processing

Challenge: Processing diverse claims documents is time-consuming and error-prone.

DocVu.AI’s Solution:

- Extracts data from claims forms, invoices, and medical reports

- Validates policyholder info and flags inconsistencies

- Triggers real-time notifications and claim updates

3. Customer Onboarding & KYC Automation

Challenge: Manual KYC delays onboarding and increases compliance risk.

DocVu.AI’s Solution:

- Automates checks on IDs, utility bills, tax forms, etc.

- Uses NLP and ML to extract and verify identity data

- Provides real-time insights for faster onboarding

4. Record Digitization & Document Indexing

Challenge: Physical records and unstructured scans hinder compliance and efficiency.

DocVu.AI’s Solution:

- Digitizes and indexes paper records with OCR and metadata tagging

- Makes documents searchable and retrievable

- Enables bulk processing and archiving

5. Invoice Processing & Accounts Payable Automation

Challenge: Manual invoice handling delays vendor payments and impacts accuracy.

DocVu.AI’s Solution:

- Extracts key fields: vendor, amount, PO number, due date

- Validates invoices against ERP or PO systems

- Triggers approval workflows and reduces cycle time

6. Compliance, Audits & Quality Checks

Challenge: Ensuring error-free, audit-ready documentation is difficult manually.

DocVu.AI’s Solution:

- Builds structured audit repositories

- Flags missing or inconsistent documentation

- Supports version control, quality checks, and compliance workflows

Seamless Integration with Legacy Systems

DocVu.AI offers flexible integrations with:

- Loan Origination Systems (LOS)

- Document Management Systems (DMS) like Alfresco

- ERP platforms

- Custom internal platforms

This ensures smooth adoption without disrupting your existing tech stack.

Key Features of DocVu.AI

- Pre-trained AI models

- Natural Language Processing (NLP)

- Document parsing and classification

- Data validation and transformation

- API integrations

- Advanced analytics dashboards

- End-to-end process orchestration

Benefits of Using DocVu.AI

- End-to-End Automation – Reduce manual labor

- Improved Accuracy – Validate extracted data automatically

- Cost Efficiency – Save on labor and error correction

- Faster Turnaround – Speed up processing time

- Enterprise-Grade Security – Keep sensitive data secure and compliant

Is DocVu.AI Right for Your Business?

Whether you are a mortgage lender, insurance provider, finance team, or operate in document-heavy industries, DocVu.AI is built to scale. With seamless integration, enterprise-grade support, and AI-powered flexibility, it empowers businesses of all sizes to move from paper to productivity.

Conclusion

AI-powered Intelligent Document Processing is not just the future it’s already transforming how businesses operate. With DocVu.AI, you can automate documents faster, achieve higher accuracy, and reduce operational costs. Add in Generative AI, and you have a solution that redefines enterprise document workflows.

Ready to automate your document workflow?

Request a Demo for DocVu.AI today

Frequently Asked Questions

While OCR converts images to text, IDP uses AI and ML to interpret, extract, and validate data intelligently.

Yes. DocVu.AI supports API-based integrations with DMS, LOS, ERP, and custom platforms.

Absolutely. It uses enterprise-grade security protocols to protect document data throughout the processing cycle.