Introduction

Why do reporting delays still happen, even when finance teams have the numbers at their fingertips? The answer usually lies not in the data, but in the documents behind the data. Scattered formats, missing fields, and time- consuming validations slow down monthly closings, audit prep, and vendor reconciliations. For CFOs, this means repeated bottlenecks in processes that should run like clockwork. DocVu.AI is designed to solve this with intelligent document classification, data extraction, and automated gap detection, which is purpose-built for finance operations. It integrates directly into ERP or accounting workflows, helping teams move faster without compromising accuracy. As finance leaders shift from patching process gaps to building long-term infrastructure, many are turning to DocVu.AI to bring order, speed, and control into their daily finance operations.

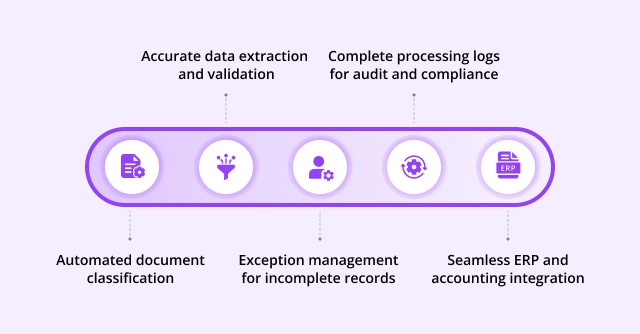

5 reasons CFOs are choosing DocVu.AI

- Automated document classification

Identifies and organizes finance documents such as invoices, contracts, and statements using AI. - Accurate data extraction and validation

Captures key fields and cross-verifies data to reduce manual entry errors and improve reporting accuracy. - Exception management for incomplete records

Flags missing or inconsistent information before it reaches ERP or accounting systems. - Seamless ERP and accounting integration

Delivers clean, structured data into existing platforms via secure, API- driven workflows. - Complete processing logs for audit and compliance

Maintains structured records of document actions, approvals, and validations to support financial audits and regulatory reporting.

Here are some frequently asked questions about DocVu.AI

What challenges do CFOs face in traditional finance operations, and how does DocVu.AI address them?

Many CFOs deal with delayed closings, inconsistent data, and heavy manual work across disconnected systems. Invoices, contracts, and approvals often sit in silos, slowing down validation and increasing the risk of errors. DocVu.AI simplifies this by automating document classification, data extraction, and gap detection. It pushes clean, verified data into ERP or accounting systems, giving finance teams more control, accuracy, and time to focus on decision-making.

How does DocVu.AI integrate with existing ERP and accounting systems?

DocVu.AI connects directly with ERP and accounting platforms to ensure finance documents are digitized, validated, and posted accurately without disrupting existing workflows.

Key integration features include:

- ERP and accounting system compatibility

Built-in support for leading platforms through secure API connections. - Accurate data mapping

Extracted document data is automatically mapped to the correct fields and formats in the target system. - Custom workflow alignment

Configurable rules and triggers ensure the platform fits your existing finance processes. - Error prevention with validation

Data is checked for accuracy and completeness before entering your core systems.

How can DocVu.AI improve the efficiency of accounts payable and receivable processes?

DocVu.AI supports finance teams by simplifying how invoices, payment records, and remittance data are processed and validated. This reduces manual interventions and allows teams to close AP and AR cycles faster and more accurately.

Key efficiencies include:

- Automated invoice classification

Identifies and organizes invoices based on document type, vendor, and transaction details. - Data extraction from structured and unstructured formats

Captures key fields such as invoice number, dates, line items, and payment terms from PDFs, scanned documents, and digital uploads. - Exception flagging for missing or inconsistent information

Alerts teams when required fields are incomplete or mismatched before approval or posting. - Clean data pushes into downstream systems

Sends validated data directly into ERP or accounting platforms to reduce delays in payment processing and reconciliation.

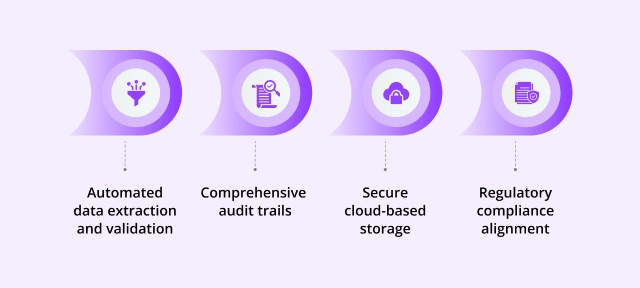

How does DocVu.AI support audit readiness and compliance reporting?

DocVu.AI enhances audit preparedness and compliance management through its intelligent document processing capabilities. By automating data extraction, validation, and classification, it ensures that financial documents are accurate, complete, and readily accessible for audits.

Key features include:

Automated data extraction and validation

DocVu.AI utilizes AI and machine learning to extract critical data from various financial documents, reducing manual errors and ensuring data consistency.Comprehensive audit trails

Every document processed is logged with detailed metadata, providing a clear history of actions taken, which is essential for regulatory compliance and internal reviews.Secure cloud-based storage

Documents are stored in an encrypted, cloud based system, ensuring data integrity and facilitating easy retrieval during audits.Regulatory compliance alignment

The platform is designed to adhere to industry standards and regulations, helping organizations maintain compliance with evolving financial reporting requirements.

Conclusion

CFOs face increasing pressure to boost accuracy, reduce cycle times, and maintain audit readiness, all without expanding resources. DocVu.AI meets these demands with focused automation built for finance that streamlines document handling, detects data gaps, and integrates seamlessly with ERP systems. By bringing clarity, control, and real-time visibility to every step of the process, DocVu.AI enables finance teams to operate more efficiently and strategically. For organizations aiming to modernize and future-proof their finance operations, DocVu.AI delivers the infrastructure needed to move forward with speed and assurance.