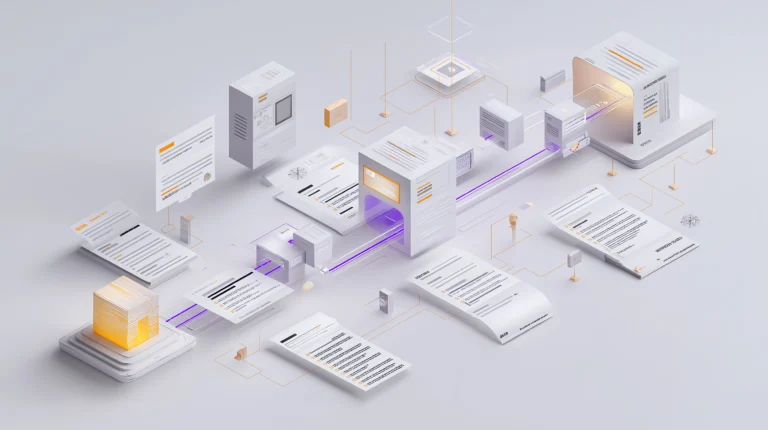

Complex, paper-based, and error-prone, the management of mortgage documents is often troublesome exposing financial institutions to the potential for unnecessary inefficiencies, losses and defaults. DocVu.AI serves as a central document library and provides a 360 degree view of mortgage documents across the organization. The dynamic forms for all application documents and collaterals type are customizable as per policies. The advanced search function allows easy access loan application parameters such as collateral ID, application ID, name and customer ID.

The solution provides quick upload, indexing, retrieval and transfer of digital documents and stores it in one unified portal segregated as per defined rules and workflows. The highly intuitive and user-friendly portal not only makes it easy to navigate through wide variety of important data sets but also improves quality and closing times. The fields can be made mandatory and non-mandatory and actions could then be taken for the missing files. This repository also comes in handy during the loan closing and post close QC stages which allows stakeholders to get all the information they need at one platform making the process much more organized.

A centralized repository of document formats ensures quick implementation of DocVU.AI and DocVu.AI can reach 100% operational capacity faster. This enables smoother transitions

LOWER ERRORS

DocVU.AI’s Centralized repository is continuously monitored and improved which leads to lower errors. this continuous optimization is based on our Machine learning algorithms that check the performance of each format.

EASIER TO ADDRESS COMPLIANCE CHANGES

With a centralized repository and DocVUÁI configuration manager, any changes to regulation or document formats can be easily and systematically addressed, which results in lower compliance costs and efforts

IMPROVED COLLABORATION, ENHANCED CUSTOMER EXPERIENCE

A centralized document library acts as a single source of truth for all the stakeholders involved in the loan processing making the communication more streamlined. The requirements for missing documents or additional documents can be quickly acted upon and everyone is in sync in real-time. For the customers, this means less to and fro of multiple requirements from the credit managers and reduced turnaround time for loan processing.

COMPLETE VISIBILITY, STREAMLINED PROCESSES

The dynamic forms can help documents to be arranged in a segregated manner. Multiple stakeholders such as field verification agents, valuation agencies, etc. can access specified documents and act upon it. The library provides a 360 degree view of the verified information with all the supporting documents to the credit managers at the underwriting stage which helps them take much more informed decisions.

DIGITIZED OPERATIONS, EFFICIENT AUDIT PREPARATION

When you get all information at one unified place for each application – the frequent audits such as pre-close audits and post close QC could be a breeze. The financial institutions could always be audit ready and be compliant with all the regulations.

BETTER CROSS-SELL OPPORTUNITIES POST ORIGINATION

The loan servicing stage provides many opportunities for a quick sale of cross sell or up sell. When your systems have a centralized repository of the previous documents, the initial analysis is more informed and your chances of a sale is better.