How Intelligent Document Processing and workflow alignment are reshaping everyday mortgage operations

As we step into 2026, Mortgage Automation is no longer judged by novelty, but by how consistently it supports day-to-day operations. Expectations have shifted: systems are now expected to understand what a file represents, identify what is missing or misaligned, and respond in line with established business logic.

Intelligent Document Processing has moved beyond basic OCR toward contextual understanding that helps files progress with fewer interruptions. The same shift is evident in Mortgage Workflow Automation, now measured by predictability and control rather than speed alone. With Automated Document Review, teams gain clearer signals, fewer manual follow-ups, and greater confidence in how work moves forward.

In this blog, we examine seven areas where mortgage automation has reached a more reliable, operational standard.

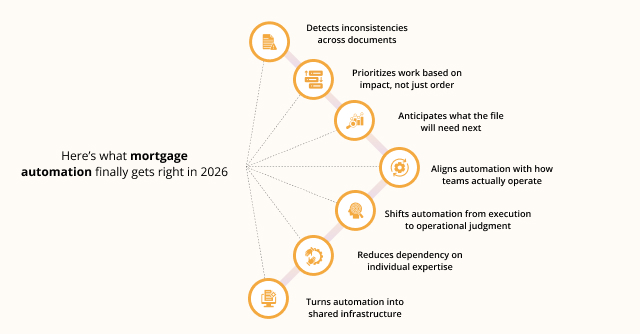

Here’s how mortgage automation finally aligning with real operations in 2026.

- Detects inconsistencies across documents, not just within them

Automation now evaluates the full file instead of isolated pages. It compares information across disclosures, statements, and supporting documents to surface misalignment early. This allows teams to address issues while the file is still active, rather than uncovering problems during late-stage review. - Prioritizes work based on impact, not just order

Files are no longer processed strictly on a first-in, first-out basis. Automation considers deadlines, dependencies, and potential downstream risk when determining what needs attention first. This ensures effort is spent where it matters most, without slowing overall throughput. - Anticipates what the file will need next

Instead of waiting for manual prompts, modern systems infer upcoming requirements based on file status and historical patterns. Requests, validations, and checks are initiated earlier, reducing idle time between steps and keeping work moving without constant follow-ups. - Aligns automation with how teams actually operate

Automation now reflects real operational behavior, including parallel reviews, shared ownership, and role-based decisions. Rather than forcing teams into rigid paths, Mortgage Workflow Automation supports how work happens on the ground, making adoption more natural and outcomes more consistent. - Shifts automation from execution to operational judgment

Automation increasingly supports decision-making by identifying meaningful exceptions, applying policy consistently, and guiding next steps. This is where Automated Document Review plays a critical role, helping teams focus on judgment-driven work while the system handles routine validation and signaling. - Reduces dependency on individual expertise

Operational knowledge that once lived with a small group of experienced reviewers is now embedded into system logic. This helps teams maintain consistency despite staffing changes, fluctuating volumes, or onboarding new team members, without lowering quality expectations. - Turns automation into shared infrastructure, not a point solution

Automation now supports the full lifecycle of a file rather than a single step. Mortgage Automation works across intake, review, decisioning, and follow-ups, while Intelligent Document Processing provides continuity across documents instead of functioning as a standalone capability.

The Missing Link Between Documents and Decisions

As automation matures, many mortgage teams still face a familiar gap: systems that work well in isolation but fall short when documents, decisions, and workflows need to stay connected. Files move faster, yet context gets lost, exceptions surface late, and teams spend time reconciling what should already be clear. That is why DocVu.AI is designed to address this gap by keeping documents, checks, and workflow logic aligned throughout the file lifecycle. By grounding automation in document context and operational rules, it supports steadier outcomes without changing how teams work day to day. The result is not a dramatic overhaul, but a quieter improvement in how files arrive, move, and get resolved.