Introduction

Documents are at the heart of business operations. From loan applications and tax returns in mortgage lending to financial reports, contracts, HR files, and compliance forms in enterprise workflows, the reliance on documents is universal.

But here’s the problem: 80% of enterprise data is trapped in unstructured formats like PDFs, scanned forms, or emails. Traditional document handling relies on manual data entry and legacy OCR tools, which are slow, expensive, and prone to errors.

That’s where DocVu.AI comes in. As an Intelligent Document Processing (IDP) platform, DocVu.AI uses AI, OCR, Machine Learning, and NLP to automatically capture, classify, extract, validate, and integrate data from complex documents.

The Pain Points of Manual Document Processing

Manual document workflows create a ripple effect of inefficiency:

1. Long Turnaround Times : Mortgage approvals can take weeks because teams must review 30–50 documents per borrower manually.

2. Error-Prone Processes: Typos, missing fields, or misclassifications create compliance risks and costly rework.

3. Data Trapped in Unstructured Formats: Scanned PDFs, handwritten forms, and diverse layouts make it hard to extract consistent, usable data.

4. Hidden Operational Costs: Staff spend 30–40% of their time on document handling, driving up costs.

5. Compliance & Audit Risks: Incomplete or misfiled documents increase the risk of regulatory fines, especially in highly regulated industries like mortgage and finance.

6. Lack of Visibility: Without analytics, enterprises don’t know how efficiently documents move through their workflows.

How DocVu.AI Works: The Intelligent Document Processing Lifecycle

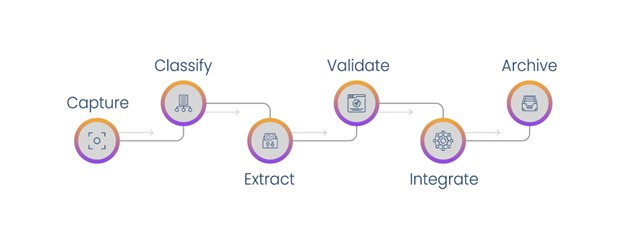

DocVu.AI automates document workflows in six key stages:

1. Capture

- Collects documents from multiple sources: borrower portals, emails, scanners, cloud storage.

- Accepts all formats: PDFs, images, handwritten notes, TIFFs.

2. Classify

- Automatically identifies document types (e.g., pay stubs, bank statements, tax returns, contracts).

- Works template-free — no pre-set formats needed.

3. Extract

- AI + OCR pull out key fields: borrower info, income details, tax IDs, account balances.

- Handles structured (forms), semi-structured (statements), and unstructured (contracts) data.

4. Validate

- Built-in business rules check for missing or mismatched data.

- Example: Verify borrower income across W-2s, pay stubs, and tax returns.

- Human-in-the-loop allows exception handling when needed.

5. Integrate

- Clean, structured data flows directly into Loan Origination Systems (LOS), ERP, RPA, and compliance tools.

- Eliminates duplicate data entry.

6. Archive

- Secure, searchable storage with metadata tagging.

- Ensures audit readiness and supports compliance with SOC 2, GDPR, HIPAA.

Key Benefits of DocVu.AI

Faster Processing: Reduce document turnaround times by 70% or more, accelerating mortgage approvals and financial reporting.

Higher Accuracy: AI-powered extraction reduces error rates by up to 90%, minimizing compliance risks.

Cost Efficiency: Cut document processing costs by 60–80% by reducing manual workloads.

Compliance & Audit-Ready: Automatically maintain complete, accurate, and easily searchable records for regulators.

Real-Time Insights: Analytics dashboards track:

- Processing time per document

- Exception rates

- Compliance errors

- Operational throughput

Scalability: Process millions of documents monthly without adding staff.

Why Choose DocVu.AI Over Traditional OCR?

Traditional OCR solutions fall short:

- They only convert images to text.

- They rely heavily on templates that break with format changes.

- They lack validation, compliance support, and integration.

DocVu.AI goes further:

- AI + NLP for context-aware understanding.

- Template-free learning adapts to any layout.

- Human-in-the-loop for exception handling.

- Enterprise-grade integration with LOS, ERP, CRM, and RPA.

- Analytics-first approach for visibility and optimization.

The Future of Document Processing with DocVu.AI

The next era is touchless document processing:

- Zero-touch mortgage onboarding: Borrowers get approvals in hours, not weeks.

- Proactive compliance: AI checks and flags issues before they become violations.

- Global scalability: Multi-language, multi-format processing for international businesses.

With DocVu.AI, enterprises can future-proof their operations, reduce costs, and focus on delivering better customer experiences.

Conclusion

Manual document processing is no longer sustainable in today’s fast-moving business landscape. Organizations need speed, accuracy, compliance, and scalability.

With DocVu.AI’s Intelligent Document Processing, enterprises can:

- Accelerate loan and financial approvals

- Reduce compliance risks

- Cut costs

- Scale seamlessly across industries

Ready to transform your document workflows? Contact DocVu.AI today to see automation in action.

Frequently Asked Questions

DocVu.AI is an Intelligent Document Processing platform that automates document-heavy workflows in mortgage, finance, and enterprise operations.

Unlike OCR, which only digitizes text, DocVu.AI uses AI, ML, and NLP to classify, extract, validate, and integrate data into enterprise systems.

Yes. It processes structured (forms), semi-structured (statements), and unstructured (contracts, handwritten docs) with high accuracy.

Yes. It provides audit trails, metadata tagging, and secure archiving to meet compliance standards.

Because it is template-free, setup is faster than legacy OCR. Implementation timelines vary but are typically weeks, not months.

Yes. It integrates seamlessly with Loan Origination Systems, ERP, RPA, CRM, and compliance platforms via APIs.

- Mortgage lenders & servicers who need faster, compliant onboarding

- Finance teams seeking automation of reconciliations and audits

- Enterprises managing large volumes of HR, legal, and compliance documents

Yes. Human-in-the-loop verification ensures exception cases are reviewed without compromising automation efficiency.