Customer Onboarding and KYC

Seamless Customer Onboarding with Automated KYC Solutions

Offer a streamlined user experience and expedite customer onboarding by avoiding tedious manual processing.

Customer information in multiple silos?

Customer authentication and KYC process is time consuming. Redundant authentication methods and sluggish processes can reduce customer onboarding experience. Unless these needs are processed quickly, customer onboarding will continue to struggle to offer faster resolutions.

Break the information silos and onboard customers faster

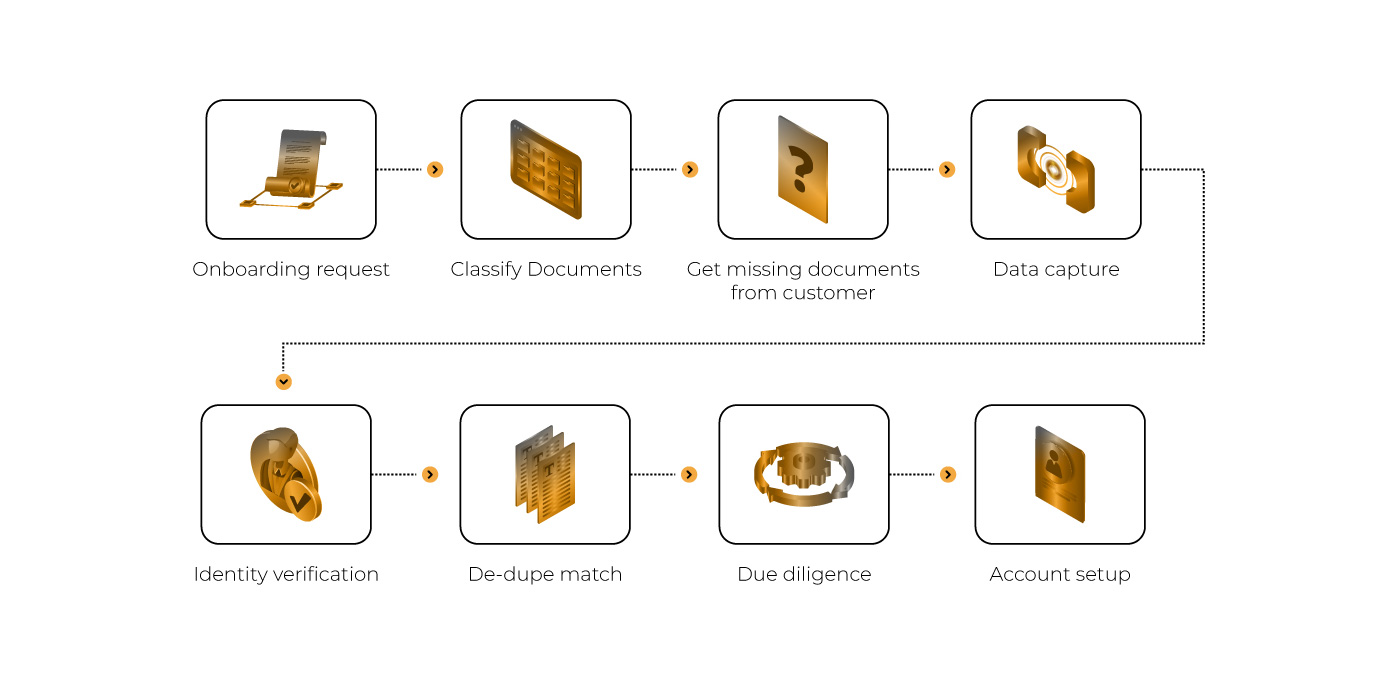

DocVu.AI’s Intelligent document processing solution uses AI to identify, capture, classify, and record customer data automatically, irrespective of their formats, within minutes. DocVu.AI’s template less document processing extracts information fast and eliminates efficiency bottlenecks to enhances the quality of customer data management effortlessly.

Applications

DocVu.AI Capabilities

Identity, employment, and Address Verification

Fraud Detection & De-duplication

Data Security

Automate customer/client onboarding document processing with DocVu.AI, an automation solution.

Improve your document processing speed and enhance your data extraction efficiency using DocVu.AI

Case Studies

Stay informed with the latest on the Industries we work with and news updates from our company.

How DocVu.AI Revolutionized ‘Order to Cash Process’ for a Leading Pharma Chain

Please submit this form to download Case Study

Bank in North America to Achieve Excellence in Post-Close Audit using IDP solutions

Please submit this form to download Case Study

Knowledge Centre

Keep updated with our resources on mortgage industry and the latest company updates

7 Mortgage Document Challenges Lenders Can’t Ignore in 2026 and How DocVu.AI Solves Them

Mortgage lenders currently face an operational paradox. While global lending volume is projected to grow steadily through 2030, the internal

Mortgage Data Extraction: The Complete 2026 Guide Using AI & IDP

Every mortgage loan file tells a story, but that story is buried under hundreds of pages of documents. Bank statements,

The Future of Mortgage Automation: How Intelligent Document Processing Is Transforming 2026

The mortgage industry is entering a defining phase. By 2026, lenders will no longer compete only on interest rates rather

How would you like to partner with us?

Want to know how DocVu.AI makes document processing efficient? Get in touch with us!

Frequently Asked Questions

Traditional customer onboarding processes are time-consuming and can suffer from redundant authentication methods and sluggish processes, leading to a poor customer experience.

DocVu.AI uses AI to identify, capture, classify, and record customer data automatically, eliminating efficiency bottlenecks and enhancing data management.

DocVu.AI handles identity, employment, and address verification by collecting and recording data from documents like driver’s licenses, birth records, social security cards, and passports.

DocVu.AI incorporates fraud detection algorithms and de-duplication processes to keep customer data safe and prevent digital fraud.

DocVu.AI follows the latest cybersecurity protocols to protect customer data and prevent misuse by hackers or malicious websites.