Introduction:

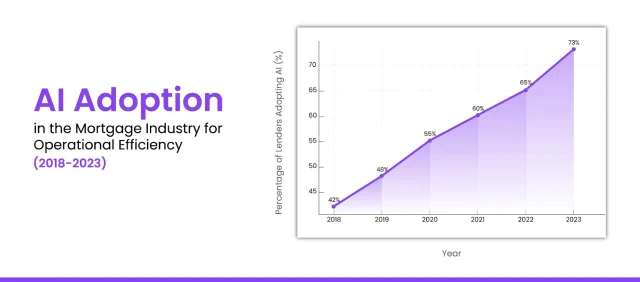

Managing the loan process from application to payoff in today’s mortgage industry is challenging. Many lenders struggle to balance compliance and operational efficiency. As regulations become stricter, the demand for automation has surged, with 73% of lenders prioritizing technology to boost efficiency. Automation is transforming underwriting, document verification, and fraud detection, streamlining workflows, and enhancing outcomes. Automated document processing also accelerates application reviews and reduces human error, increasing overall accuracy. In this blog, we will discover the benefits of integrating AI into the mortgage lifecycle and its operations

How do Artificial Intelligence and Data Analytics facilitate lending life cycle

transformation?

Predictive analytics for creditworthiness assessment

One of the key advancements in the mortgage sector is the automation of the document verification process. Technologies such as Intelligent Character Recognition (ICR) and Intelligent Document Processing (IDP) are integrated to enhance the early document verification stages, enabling quick analysis and validation of large quantities of documents, including pay stubs, bank statements, and identification records. This approach not only accelerates the application process but also reduces the likelihood of human errors often associated with manual reviews.

- Rapid access to mortgage documents

Leveraging advanced algorithms, ICR and IDP enable lenders to process documents at remarkable speeds, minimizing bottlenecks in the application pipeline. - Enhanced compliance checks

Automated systems can ensure that all necessary documentation meets regulatory standards, providing lenders with peace of mind and reducing compliance-related risks.

Improved and effective loan monitoring

Lenders can effectively manage high-risk accounts and potential defaults by leveraging data analysis from AI-powered algorithms. These algorithms pull information from a variety of sources, providing a more comprehensive view of each borrower’s financial situation. In the lending lifecycle, real time loan monitoring allows lenders to stay informed about emerging risks, helping them detect potential defaults early.

- Proactive risk identification

By analyzing patterns in borrower behavior and financial trends, lenders can identify potential risks before they escalate, enabling timely intervention. - Comprehensive financial insights

AI-driven analysis offers lenders a detailed view of borrowers’ financial health, integrating data from credit scores, payment history, and external economic factors for informed decision making.

Transforming underwriting with efficiency

The underwriting process is often slow and prone to human error due to its reliance on manual reviews of financial documents, credit reports, and employment history. One of the biggest challenges is managing large volumes of unstructured data, such as bank statements and tax returns, which can lead to delays and inaccuracies. AI-driven underwriting systems have shown a 30% reduction in processing time, as they analyze vast amounts of data with precision and speed, ensuring that important financial details are not overlooked.

- Accelerated data processing

AI technologies efficiently handle large datasets, allowing for quicker reviews and decisions without sacrificing accuracy. - Reinforced data consistency

By standardizing data analysis, AI-driven systems help ensure that all financial information is evaluated consistently, reducing the risk of oversight during the underwriting process.

Reducing mortgage processing times

In recent years, the U.S. mortgage industry has been increasingly turning to AI technologies to streamline the loan approval process. Traditionally, mortgage approvals could take several weeks due to manual document handling and data verification. With AI advancements, lenders are now able to analyze vast amounts of data more efficiently, cutting down processing times and improving the overall customer experience.

- Faster document review

AI systems can process complex documents like tax returns and bank statements in minutes, whereas manual reviews would typically take days. - Improved decision-making

AI algorithms analyze borrower information from unstructured data sources, providing lenders with faster, more accurate insights to approve or decline applications, leading to a quicker turnaround for applicants.

Ensuring compliance in mortgage origination

Mortgage lenders face rigorous regulatory requirements, such as those outlined in the Dodd Frank Act and the Truth in Lending Act (TILA), which are designed to protect consumers and ensure fair lending practices. Ensuring compliance with these regulations involves meticulous documentation, data validation, and verification processes. When handled manually, this can significantly slow down the mortgage approval timeline, as each document must be thoroughly reviewed for accuracy and compliance. This adds a layer of complexity to an already time consuming process, increasing the chances of delays and potential errors.

- AI-powered accuracy

AI tools can automate the compliance review process, ensuring all documentation adheres to regulatory standards, significantly reducing the risk of errors. - Faster compliance checks

AI can quickly analyze large volumes of data and documentation, accelerating compliance checks and enabling lenders to meet regulatory requirements more efficiently.

Mortgage closing and servicing: A unified approach

The mortgage closing and servicing phases are critical in the loan lifecycle, as they directly impact borrower satisfaction and overall operational efficiency. Closing involves finalizing the loan agreement, where accurate documentation and compliance with regulations are paramount. Following closing, effective servicing is essential for maintaining customer relationships and managing payment processing. Integrating technology in these stages can facilitate smoother transitions and better communication between lenders and borrowers.

- Timely communication

Utilizing automated notifications helps keep borrowers informed about important deadlines and required documentation, reducing confusion during the closing process. - Comprehensive account management

Advanced servicing solutions provide lenders with tools to monitor loan performance and manage customer inquiries, allowing for better support and long-term borrower engagement.

This graph illustrates the adoption of AI for operational efficiency in the mortgage industry from 2018 to 2023. The data shows a steady increase in AI usage among lenders, reaching a peak of 73% in 2023, as reported by Fannie Mae. The adoption of AI has enabled lenders to streamline processes such as underwriting, document verification, and compliance management, significantly improving processing times and reducing errors. This trend highlights the growing role of AI in making the mortgage process more efficient and effective. And the shift in the graph is expected to grow significantly by 79% by the year 2028.

Conclusion

Integrating AI and data analytics is reshaping the mortgage process, making it faster, more efficient, and more accurate at every stage. From automating document verification to improving underwriting and streamlining the closing process, AI helps lenders reduce errors and meet compliance standards more effectively. This allows lenders to focus on delivering a better overall experience for borrowers, while also managing risks and staying compliant with industry regulations.

- Operational efficiency

AI automates manual tasks like document verification and underwriting, saving time and reducing errors. - Improved borrower experience

Faster approvals and accurate assessments lead to a smoother, more transparent mortgage process for borrowers.

Lenders that embrace these innovations will be better equipped to thrive in a rapidly changing mortgage landscape.