Mortgage Servicing Rights (MSR) onboarding is a high-stakes, document-heavy process. Each transfer involves multiple loans, and every record must be validated before servicing begins.

For one leading US bank, this was easier said than done.

Multiple data sources, manual document checks, and tight timelines meant teams were spending more hours verifying files than actually preparing them for servicing. Errors had to be corrected in a hurry. Volumes were rising, but the process wasn’t getting any faster.

The bank knew that adding more people to the process would not fix the problem. They needed a better way to handle the scale, without losing accuracy. That’s when they approached DocVu.AI.

The Challenges

The bank’s servicing operations team was responsible for validating every document in a Mortgage Servicing Rights (MSR) transfer from loan agreements to escrow statements. Each package could run into hundreds of pages.

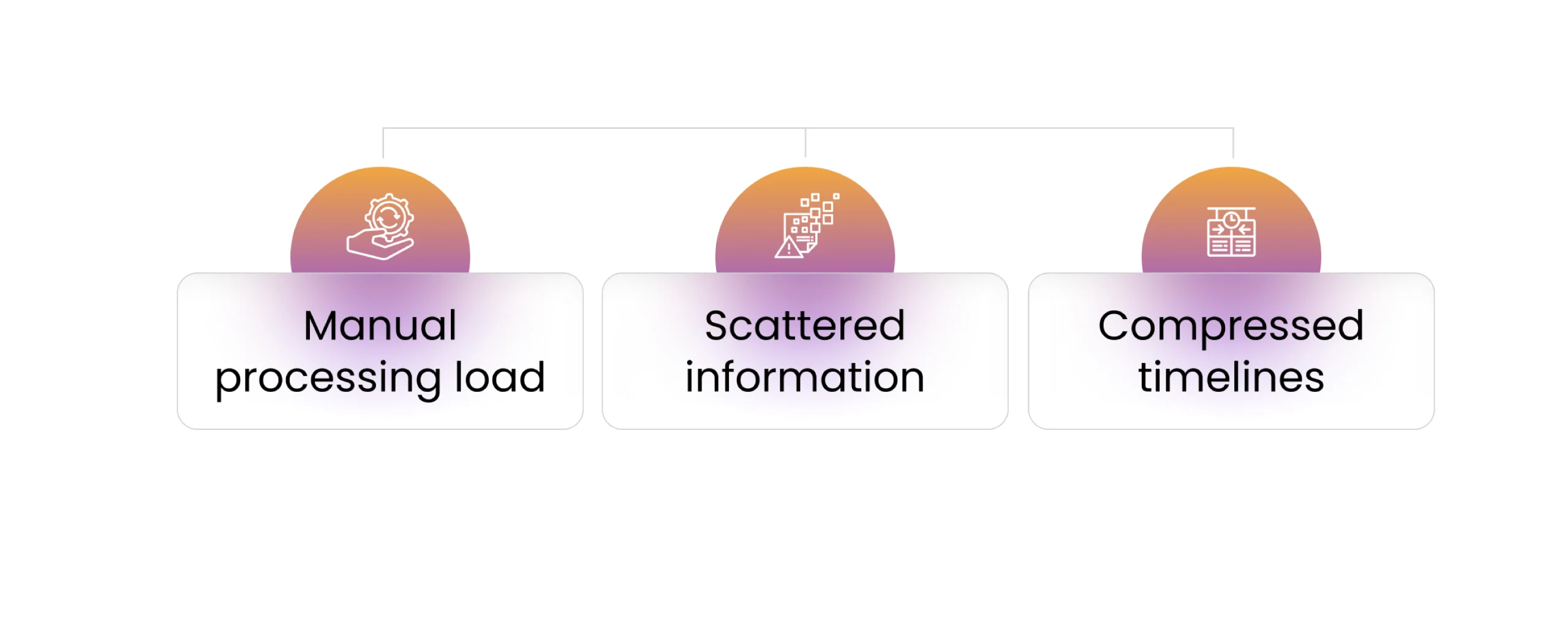

The key issues were:

- Manual processing load: Each document had to be opened, reviewed, and cross-checked by hand.

- Scattered information: Data points were spread across multiple systems, making validation slow.

- Compressed timelines: Transfers had to be completed within weeks to meet contractual obligations.

With these factors combined, the bank was looking at a process that was both time-consuming and prone to delays.

The Solution

DocVu.AI worked closely with the bank to understand their existing approach and identify where automation could take over repetitive, error-prone tasks. The project began with mapping every step of the onboarding process, from the moment data arrived to the final validation.

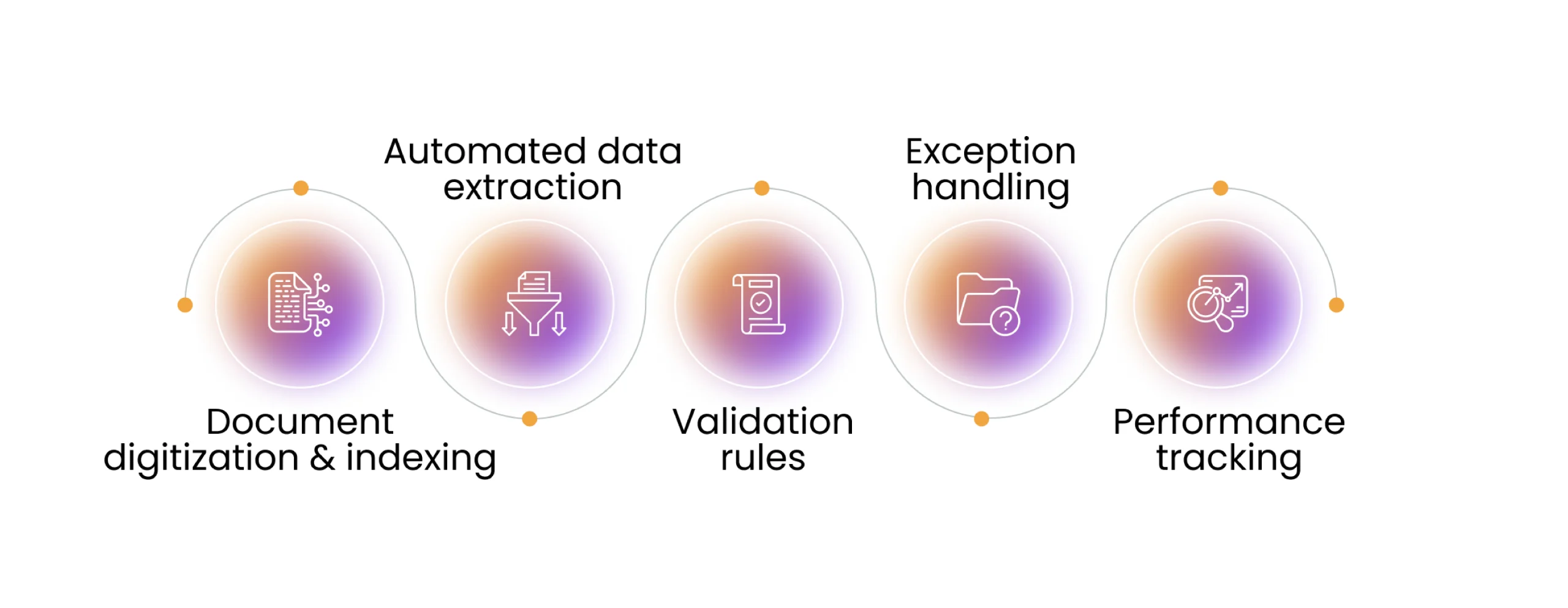

Key elements of the solution included:

- Document digitization and indexing – All incoming loan files were converted into searchable digital formats, with each page automatically tagged to its corresponding loan record.

- Automated data extraction – The system pulled key loan information, such as borrower details, payment histories, and escrow balances, and matched them against servicing requirements.

- Validation rules – Custom checks were set up to compare extracted data against the bank’s compliance and investor standards.

- Exception handling – Any missing or mismatched data was flagged instantly for review, allowing the bank’s team to focus only on files that needed attention.

- Performance tracking – Detailed reports helped the bank monitor accuracy, turnaround time, and exception rates.

The implementation was completed in just eight weeks from kickoff to production.

The Results

The impact was clear within months. By shifting the heavy lifting to DocVu.AI’s intelligent document processing, the bank was able to handle larger volumes without extending deadlines.

- 200% increase in the number of loans processed within six months of go-live.

- 99.20% average accuracy maintained for three consecutive years after implementation.

The bank’s servicing operations team now spends far less time on manual verification and more on managing exceptions, investor communications, and customer experience. The process is faster, accuracy is higher, and the team has the capacity to take on more transfers without added stress.

A Clear Path Forward

For the bank, MSR onboarding has moved from being a race against the clock to a predictable, well-managed process. Instead of reacting to delays, they can plan their servicing schedules with confidence.

As mortgage portfolios continue to shift hands in the secondary market, the ability to onboard quickly and accurately will remain a competitive advantage. This bank has shown that with the right technology partner, it’s not just possible, it’s repeatable.

DocVu.AI continues to support the bank with enhancements, helping them keep pace with evolving regulatory requirements and servicing demands.

If your institution is looking to handle MSR onboarding at scale without sacrificing accuracy, connect with DocVu.AI to see how our intelligent document processing can deliver the same results.