Introduction

Every mortgage file is a mountain of paperwork, from loan applications and tax returns to pay stubs, credit reports, IDs, closing disclosures, and more. On average, a single loan can require 300+ pages of documentation.

For lenders, this volume translates into slower approvals, higher operational costs, and compliance risks if documents are incomplete or mismanaged.

DocVu.AI helps mortgage lenders overcome these challenges by using Intelligent Document Processing (IDP) to power end-to-end mortgage automation—from onboarding and underwriting to funding and loan servicing. By automating data extraction, document classification, and compliance checks, lenders can accelerate approvals, reduce costs, and deliver a smoother borrower experience.

The Role of Intelligent Document Processing in Mortgage

Unlike traditional OCR that only digitizes text, IDP understands the context of mortgage documents. This makes it possible to:

- Recognize different borrower forms.

- Extract key data fields like income, debt, and credit information.

- Cross-validate numbers across multiple documents.

- Ensure files are complete and compliant before underwriting.

How DocVu.AI Automates Mortgage Workflows

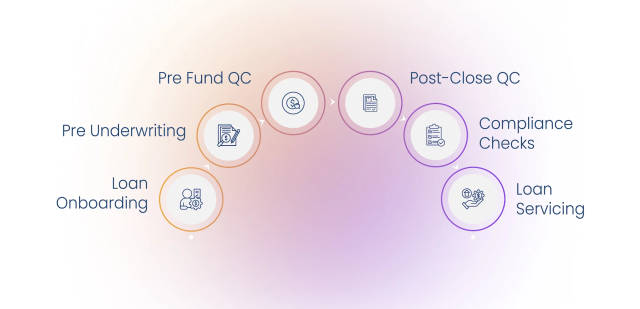

1. Loan Onboarding

- Capture documents from borrower portals, emails, or uploads.

- Classify forms automatically (W-2, tax return, bank statement).

- Extract borrower details and loan details without manual intervention.

2. Pre Underwriting

- Validate income across multiple sources (pay stubs vs. tax forms).

- Highlight discrepancies for faster review.

- Deliver structured, clean data into LOS for risk assessment.

- Identify missing documents for faster underwriting

3. Pre Fund QC

- Verify loan data and documents before funding.

- Ensure borrower eligibility, property details, and compliance requirements are accurate.

- Reduce the risk of costly errors and funding delays.

4. Post-Close QC

- Conduct automated audits of closed loan files.

- Identify documentation gaps or compliance issues.

- Maintain investor-ready packages to minimize loan buybacks.

5. Compliance Checks

- Confirm required disclosures and regulatory forms are included.

- Maintain audit-ready digital archives.

- Reduce risk of loan buybacks from investors.

6. Loan Servicing

- Extract and classify data from servicing documents such as payment records, escrow statements, and modification requests.

- Automate monitoring for delinquencies, forbearance, and loan modifications.

- Deliver accurate, real-time borrower data to strengthen customer servicing, compliance, and portfolio management.

Key Benefits for Mortgage Lenders

- Faster Approvals: Loans processed in hours instead of days.

- Higher Accuracy: Reduce re-keying errors and missing fields.

- Lower Costs: Save 50%–60% on manual processing costs.

- Compliance Confidence: Always audit-ready with complete files.

- Better Borrower Experience: Quicker, smoother mortgage approvals.

Future of Mortgage Lending with DocVu.AI

The mortgage industry is moving toward touchless loan origination. With DocVu.AI:

- Borrowers will get faster approvals.

- Underwriters will spend less time on prep and more on risk analysis.

- Lenders will reduce compliance risks and improve investor confidence.

Conclusion

Mortgage lenders face rising competition and tighter margins. Success depends on how fast and accurately they can fund the loan.

With DocVu.AI’s Intelligent Document Processing, lenders can:

- Speed up loan origination

- Improve compliance

- Enhance borrower experience

- Scale operations efficiently

Ready to modernize your mortgage workflows? See how DocVu.AI can transform your lending operations today.

Frequently Asked Questions

DocVu.AI can process all key documents in the mortgage lifecycle, including loan applications (1003), W-2s, pay stubs, tax returns, credit reports, IDs, closing disclosures, bank statements.

By automatically capturing, classifying, and extracting borrower data, DocVu.AI eliminates manual data entry. This reduces onboarding time from days to hours, helping lenders deliver faster approvals and a smoother borrower experience.

Yes. DocVu.AI prepares clean, validated, and structured data so underwriters spend less time on paperwork and more time on risk assessment and decision-making.

DocVu.AI creates audit-ready digital records, verifies document completeness, and ensures proper classification. It helps lenders comply with CFPB, SOC 2, GDPR, and investor requirements while reducing compliance risks.

Yes. Its AI + OCR engine processes handwritten notes, signatures, low-quality scans, and complex layouts, ensuring no borrower information is missed.