In 2025, mortgage operations demand more than speed, they require accuracy, compliance, and scalable systems that won’t crack under pressure. That’s where DocVu.AI comes in. Designed for lenders and servicers, it is an intelligent document automation platform built to manage high volumes of complex, regulated content with precision. From classification and data extraction to audit-ready reporting, DocVu.AI helps organizations turn documents into reliable assets for decision-making.

At the heart of the platform is DMSVu, DocVu.AI’s intelligent document management system. Unlike legacy tools that rely on rigid templates, DMSVu adapts to evolving formats and jurisdictional requirements.

It empowers mortgage servicing and origination teams to move faster, reduce errors, and stay compliant under investor scrutiny. For organizations facing growing loan volumes, mortgage document management with DMSVu provides the foundation for sustainable scale where mortgage origination automation is not a future goal, but a daily reality.

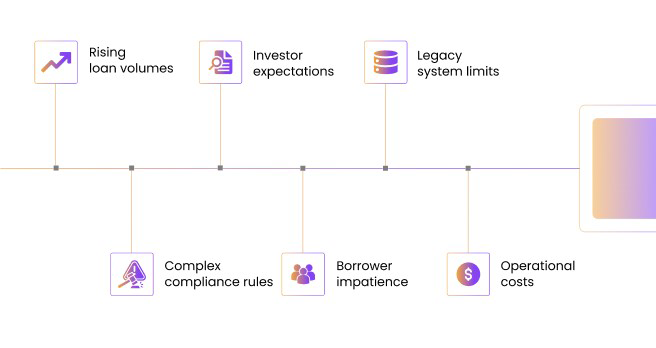

Why scalability is the biggest challenge in mortgage operations today

The pressure to scale isn’t abstract, it’s the daily reality for lenders and servicers navigating 2025. Here are six reasons scalability has become the defining challenge:

- Rising loan volumes

Spikes in demand can overwhelm manual teams, especially when volumes swing unpredictably. - Complex compliance rules

Each jurisdiction brings its own regulations, and missing even one detail can trigger costly rework. - Investor expectations

Investors now demand faster, transparent reporting, leaving little tolerance for delays. - Borrower impatience

Today’s borrowers expect quick answers and seamless experiences, even in back-end processes like mortgage servicing. - Legacy system limits

Traditional document management tools weren’t built to handle dynamic, high-volume environments. - Operational costs

Scaling with people alone is unsustainable; efficiency must come from smarter systems, not larger headcounts.

What legacy document management fails to deliver

Let’s be real: most older document management systems (DMS) simply weren’t built for the modern era. Here’s what they fall short on, especially for lenders and servicers striving to scale:

- Rigid, template-based processing

Legacy DMS platforms often require pre-formatted templates, making it tough to adapt when document formats shift, impacting speed and accuracy. - Poor integration with mortgage workflows

When a system can’t easily connect to origination or servicing platforms, it creates silos and slows downstream tasks. - Manual quality control and error handling

Without embedded checks, teams spend time manually validating documents, increasing delays and the risk of compliance misses. - Limited support for high-volume operations

Many legacy DMS tools buckle under scale, they weren’t engineered for thousands of loans or terabytes of documentation. - Lack of audit-ready traceability

Fewer systems automatically log who handled what, when. That leaves mortgage teams scrambling when regulatory or investor audits hit. - Inflexible rule configuration

Adjusting to new requirements, investor checklists, or state-level policies often means IT-heavy work, slowing down responsiveness.

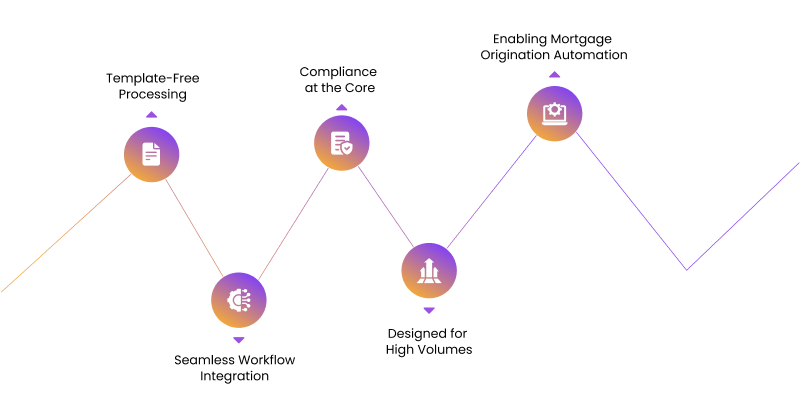

Why DMSVu is the Future of Document Management in Mortgage Operations

- Template-Free Processing

DMSVu removes the limitations of rigid templates. It adapts to multiple document formats across mortgage servicing and origination, ensuring lenders can manage change without costly system adjustments. - Seamless Workflow Integration

The platform integrates directly with servicing and origination systems, reducing silos and enabling true end-to-end mortgage document management that supports faster decisions and fewer delays. - Compliance at the Core

With audit-ready trails built into every process, DMSVu embeds compliance into daily operations. This reduces manual checks and strengthens confidence with regulators and investors alike. - Designed for High Volumes

Built to scale, DMSVu manages thousands of loans and large document sets without compromising accuracy. It ensures operational stability as lenders face rising demands. - Enabling Mortgage Origination Automation

For originators, DMSVu automates classification and validation tasks. This reduces manual intervention and shortens loan cycles, making mortgage origination automation a practical, everyday reality.

Final Thought

Scalability is no longer a choice for mortgage lenders and servicers; it is a requirement shaped by growing loan volumes, evolving regulations, and rising borrower and investor expectations. Legacy systems that once supported document processes are now showing their limits. Intelligent platforms such as DMSVu represent the next step forward, offering flexibility, compliance, and operational stability. The question for lenders and servicers isn’t if they need to scale—it’s how. With platforms like DMSVu, the industry can meet today’s demands while preparing for tomorrow’s growth.