Accounts payable is a crucial aspect of maintaining positive cash flow and strong vendor relationships in most companies, especially larger ones. It’s easy to underestimate the importance of maintaining good relationships with vendors until you need their support for rush orders or special pricing.

Unfortunately, AP teams often face various challenges in their daily work. For example, what happens when an invoice appears but there is no matching purchase order in the system? What about when a late invoice notice arrives, but no one remembers seeing the original request for payment? These problems can quickly affect a business’s reputation and relationships with suppliers if they persist.

Although addressing these problems may seem tedious, advancements in technology have made it easier to establish a seamless accounts payable process with minimal disruption. According to a survey, 83% of accountants agree that investing in the latest technologies and digitalization is necessary to keep up with the market. This article explores the most common accounts payable problems and provides solutions to address them. It covers the following topics:

- The 7 most common accounts payable problems

- Solutions to improve accounts payable weaknesses

- Staying ahead of the curve

- Conclusion

7 Most Common Accounts Payable Problems

In most AP departments, especially in larger companies, encountering at least one of the following issues is highly likely. These problems can result from human error, poorly defined processes, or technical failures, but they all share a common consequence: a negative impact on the department’s work. If multiple issues persist, it can significantly harm your business.

Here are seven areas for improvement.

Slow Processing: If your office is still relying entirely or partially on paper-based processes, it’s worth considering the number of desks an average invoice passes through before it is finally approved for payment. Each time the paperwork is handled, there is a greater risk of errors or lost documents, which can slow down your processing times. When processing times are slow, it can lead to late invoices and unsatisfied vendors who frequently inquire about their payment status.

Matching Errors: Matching errors caused by discrepancies between purchase orders, invoices, and receiving reports can result in a time-consuming manual investigation. Does your staff have the time to launch a time-consuming, multi-step investigation every time there’s a mismatch? As with other manual processes, these errors create delays with descending, slowdown effects on the department.

Follow-Ups: You’ve wrapped up a business deal with a supplier, and everything is going smoothly. But as you begin processing the invoices, you realize the data is incomplete or incorrect, generating exceptions in your system. The real work begins – the painstaking process of following up with the supplier and figuring out what went wrong. Days can go by without resolution, causing frustration and inefficiencies in your operations.

Unauthorized Purchases: When it comes to purchasing procedures, not all employees follow the rules, especially when it involves accounts payable. Some might sidestep the usual process to avoid dealing with a sluggish AP department with strict requirements. Others might go off-book and use an unapproved supplier to fulfill an urgent business need.

But here’s the catch: dealing with these unexpected invoices can take enormous time and effort, while more important invoices pile up and collect dust.

Sending Payment Before Delivery: When it comes to accounts payable, there’s a delicate balance between efficiency and accuracy. An AP team eager to avoid the rush might jump the gun and make payments before receiving the goods or services. While there are benefits to paying as soon as possible, this approach can backfire in more ways than one.

For example, if the shipment arrives damaged or with missing items, resolving the issue can be much harder once the supplier has already been paid.

The Case of the Disappearing Invoice: In the world of invoice processing, one of the most serious mistakes is simply failing to process an invoice at all. In high-pressure workplaces where teams are juggling hundreds of invoices or more, manual processes can increase the risk of misplacing or accidentally destroying invoices.

Discovering the issue later can result in a nightmare scenario of late fees owed to vendors, costing your business a pretty penny. And that’s not the only issue: lost invoices can wreak havoc on your bookkeeping practices, making it difficult to keep track of your finances and potentially leading to bigger accounting problems.

Double Payment: When it comes to invoice processing, issuing two invoices for the same order is a costly mistake that can happen all too easily. It might be as simple as a typo in the purchase order number, which generates duplicate invoices by mistake. Or it could be due to human error, like forgetting to mark an invoice as paid, leading to double payments.

These errors can significantly impact the bottom line, with costs adding up quickly. And it’s not just your business that suffers – suppliers can also be frustrated when they’re asked to refund overpayments.

A single invoice processing problem can cause significant headaches for any business. And while these issues are an unavoidable aspect of accounts payable, the truth is that they can be largely eliminated with the right approach. The key to avoiding these problems is leveraging purpose-built software solutions to streamline AP workflows. Adopting tools like DocVu.AI and its automated invoice processing capabilities can drastically reduce the risk of errors, duplication, and lost invoices. Learn how to implement these fixes now.

Solutions to Improve Account Payable Weaknesses

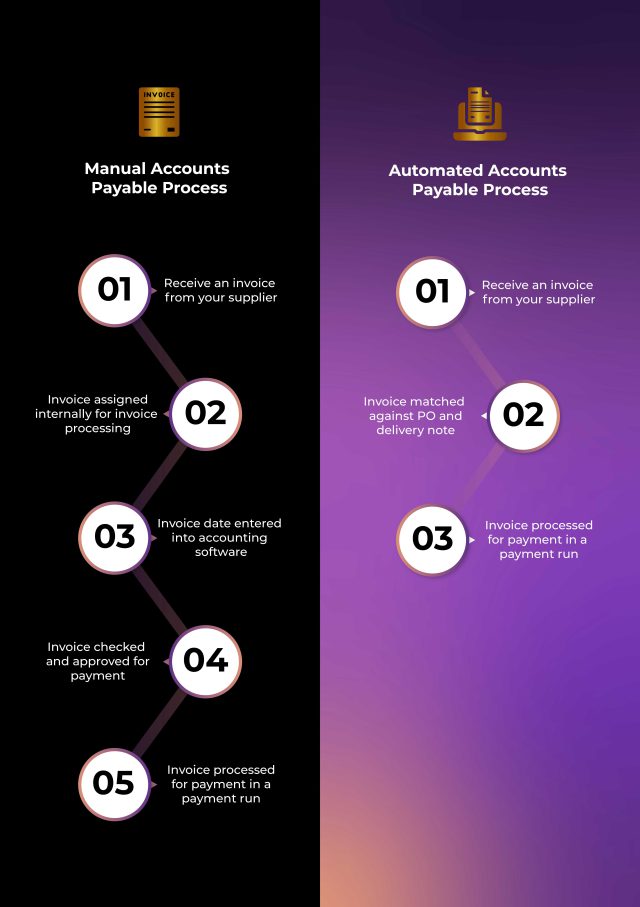

Automating the Accounts Payable Process:

What are the advantages of using automation software at every step of the AP process? Learn seven ways to reduce accounts payable discrepancies, shorten cycle times, and boost satisfaction at every step of the process.

Going Paperless: If you’re still relying on manual processes for accounts payable, it’s time to embrace the power of cutting-edge 21st-century business software. Going paperless is important, but the ability to process physical invoices automatically is also crucial. By leveraging advanced invoice processing tools, electronic payment systems, and top-down views of the full AP cycle, you can effectively eliminate common AP problems.

While AP automation does come with challenges, they are far fewer and less serious than the issues that arise from continuing to depend on outdated paper-based processes.

Excel Needs to Go: Despite the availability of superior software solutions for AP departments, many still rely on clunky and bulky Excel spreadsheets to manually track invoices and payment information. But why settle for an outdated and error-prone system when so many better options are available?

By ditching Excel and transitioning to purpose-built AP software, you can streamline your workflows and unify all your data under one roof.

Streamline Your Workflows: Standardize the way that your AP team handles each step of the process. By establishing best practices, you can eliminate unnecessary steps and reduce the number of touches that an invoice requires.

Use Three-Way Matching: Improved software simplifies three-way matching and allows you to avoid exceptions and double payments. Rapid matching also enables early payment to receive supplier discounts without paying too soon.

Invest in AP Automation: Automated AP processes mean fewer errors. Cognitive capture automation systems, powered by machine learning, automate invoice intake processing and payment authorization.

Improve Systems Integration: Break down data silos by integrating AP into your ERM platform. Gain real-time insights and ensure every team member works from the same pool of information without worrying about stale data.

Leverage Early Payment Discounts and Incentives: Using automation software can help balance payment discounts and cash flow by ensuring invoices are authorized before the discount deadline, allowing for more flexible cash-on-hand capabilities.

Staying ahead of the curve

AP automation goes beyond solving common challenges in invoice and payment handling. Instead of just fixing shortcomings, it enables teams to expand their capabilities and do more. How can you give your business the best chance to eliminate invoice processing errors and lay the groundwork for future efficiency?

- Go Digital Today

- Automate Your Troublesome Processes

- Invest in AI for the Future

In Conclusion…

Inefficient accounts payable processes can have severe consequences for a business, from unhappy vendors to disrupted operations. Recognizing the specific challenges of invoice processing is crucial to implementing effective solutions. By transitioning to AI-powered digital workflows, companies can streamline bookkeeping, ensure timely payments, and take advantage of discounts.

To address these challenges, it’s essential to acknowledge the gap between ideal AP practices and the reality of daily issues. Implementing the right tools, such as DocVu.AI’s advanced AP automation software, including invoice processing, can help eliminate bottlenecks and improve efficiency. Take the next step towards optimizing your AP processes and explore the benefits of DocVu.AI today.