Mortgage origination no longer operates as an isolated stage, it sets the tone for the entire Loan Origination-to-Life (LOTL) journey. Every data point captured, every rule applied, and every exception resolved in this phase impacts underwriting, servicing, compliance, and secondary markets down the line.

Yet, many lenders still treat origination as a standalone workflow instead of the intelligence backbone of LOTL. The result is inefficiency disguised as progress. The next generation of lending requires an ecosystem mindset powered by AI-Driven Origination, where accuracy, auditability, and adaptability coexist.

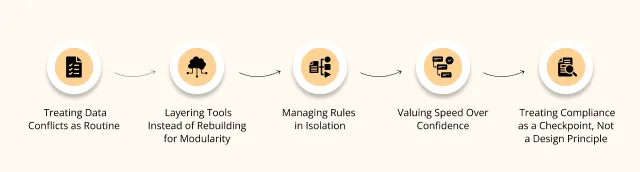

Here are five mistakes that continue to slow origination and what modern lenders are doing differently.

1. Treating Data Conflicts as Routine

Data from income statements, pay stubs, and verification feeds rarely align perfectly. When these inconsistencies go unchecked, exceptions multiply and credibility weakens.

Modern lenders rely on Intelligent Document Processing (IDP) to reconcile data across documents and systems. By validating context and consistency early, they create a single, trusted source of truth that strengthens every downstream LOTL process.

2. Layering Tools Instead of Rebuilding for Modularity

Adding automation to legacy infrastructure only creates short-term relief. As portfolios expand and data models evolve, brittle integrations limit scalability and slow innovation.

Digital Lending Transformation depends on modular, cloud-native architecture that evolves with business needs. API-first ecosystems support faster deployment, simplified upgrades, and continuous alignment between origination, servicing, and compliance teams.

3. Managing Rules in Isolation

Compliance, underwriting, and investor validation often operate on separate logic. When each domain maintains its own rules, decisions lack consistency and traceability.

Forward-looking lenders unify rule engines under a single orchestration layer. Shared logic ensures that exceptions follow the same auditable framework, reducing rework and enabling explainable automation throughout the LOTL lifecycle.

4. Valuing Speed Over Confidence

The industry still measures success by turnaround time. But faster isn’t smarter if confidence in the outcome is low.

Modern Mortgage Automation programs track data quality, confidence scores, and audit completeness as primary performance metrics. This shift reframes efficiency, not as velocity, but as reliability achieved through intelligence.

5. Treating Compliance as a Checkpoint, Not a Design Principle

When compliance is verified at the end, evidence becomes fragmented, and risk escalates. Modern lenders integrate compliance within the process itself, every action logged, every decision traceable, every rule version-controlled.

This approach transforms compliance from a cost center into a built-in assurance mechanism that supports the entire LOTL continuum.

The Way Forward

The lenders leading the future see origination as the brain of the LOTL ecosystem, a system that learns, adapts, and informs every part of the loan lifecycle.

DocVu.AI makes this possible by enabling connected intelligence, unified rule logic, and built-in auditability across lending operations.

Because the goal is no longer to close loans faster, it’s to manage them smarter across their entire lifespan.