In mortgage lending, document management has become a quiet drag on performance. From intake to audit, teams deal with scattered files, naming inconsistencies, and delays that ripple through the entire origination process. A recent 2024 HousingWire study found that over 60% of lenders cite document-related issues as the top reason for delayed closings. With tighter investor timelines, lenders are now prioritizing smarter, more structured document management systems that won’t slow down their operations.

So, what exactly is holding teams back and what needs to change? Let’s break down six recurring pain points that continue to drain time, accuracy, and confidence across mortgage document management.

Here’s where most document management systems fall short:

- Missing audit trail

When files are passed between departments or uploaded manually, there’s often no consistent record of who accessed, modified, or approved each document. This lack of audit history creates gaps during reviews and increases risk during investor or regulatory audits. A mortgage automation system should include built-in audit trails to ensure every action is tracked, verifiable, and compliant with evolving compliance in mortgage lending standards. - Incorrect document classification

In many lending environments, documents are manually labeled before being reviewed or processed. Without standardized controls, it’s easy for a bank statement to be tagged as a pay stub or a disclosure form to end up in the wrong category. These misclassifications slow down reviews and introduce compliance risk. An intelligent document management system for mortgage operations can automatically detect, classify, and route documents correctly reducing manual oversight and improving processing accuracy. - Validation is reactive, not built-in

Most systems don’t verify documents until later in the process, which means mismatches or missing data aren’t caught early. This delays reviews and increases the risk of last minute issues. A robust mortgage automation system flags problems up front format issues, missing signatures, incorrect borrower names so underwriters only see clean, complete files. - Missing documents go unnoticed

Lenders often discover missing documents only when files reach underwriting or audit. That’s too late. Without smart prompts or logic based checklists, key items like bank statements or letters of explanation get overlooked. A reliable document management system for mortgage lending ensures completeness checks are part of intake not an afterthought. - Audit preparation takes too long

When files aren’t centralized or version controlled, responding to investor or internal audits becomes a scramble. Teams waste hours pulling histories, verifying document trails, or hunting for final versions. Systems built with compliance in mortgage lending in mind maintain real-time audit trails and version logs making every file ready for review when needed. - Operations don’t scale smoothly

As volumes increase, teams are forced to add headcount or work longer hours. Manual processes don’t scale. Lenders need more than just storage; they need a mortgage automation system that can adapt to file complexity, loan types, and investor demands without relying on brute force.

How DMSVu changes the equation

DMSVu by DocVu.AI was built for mortgage operations that can’t afford delays, errors, or compliance risks. It’s not just about digitizing documents, it’s about managing them with intent and intelligence. From intake to audit, DMSVu applies automation where it matters, reducing manual steps and elevating file quality across the board.

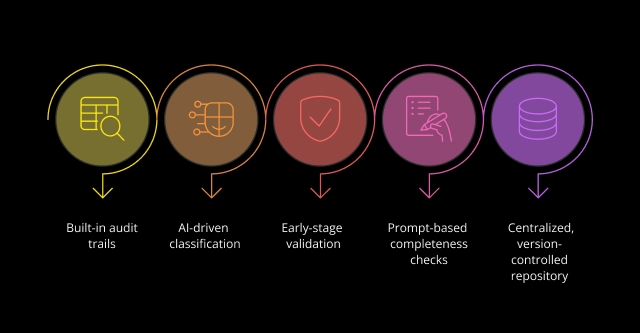

Here’s how DMSVu addresses these pain points:

Built-in audit trails

Every document action uploads, edits, approvals is logged and time stamped, ensuring full traceability for compliance in mortgage lending.AI-driven classification

Pre-trained models identify and tag documents correctly, improving accuracy and minimizing rework.Early-stage validation

Files are checked for formatting, data consistency, and missing fields at the point of entry not days later.Prompt-based completeness checks

The system detects missing documents before they delay underwriting or audit review.Centralized, version-controlled repository

Lenders get real-time access to final files and document histories, eliminating the need for back-and-forth before audits.

Built for what lending teams actually need

In a market where timelines are tight and scrutiny is high, lenders can’t afford document chaos. They need more than storage or scanning; they need control, clarity, and confidence. That’s what DMSVu by DocVu.AI delivers. By embedding intelligence into every stage of the mortgage document management lifecycle, DMSVu helps lenders move faster, reduce errors, and stay audit-ready without adding complexity.

It’s not just better technology. It’s the right foundation for how mortgage automation systems should work in 2025 and beyond.