There’s a moment every finance associate dreads the last-minute email asking for a document that should’ve been easy to find but isn’t. Not because it’s missing, but because no one remembers where it was saved, or worse, which version was final. Multiply that across vendors, invoices, audits, and month end closures, and the document management problem becomes a business risk.

Managing financial documents shouldn’t feel like a constant search for missing pieces. Yet many teams still rely on outdated tools and disjointed systems that slow down reviews, increase manual effort, and expose them to compliance risks.

So what can be done about it?

DocVu.AI answers that question through purpose-built solutions designed for clarity, control, and confidence in financial document management.

In this blog, we’ll break down 7 common challenges and how DocVu.AI is helping finance teams get ahead of them.

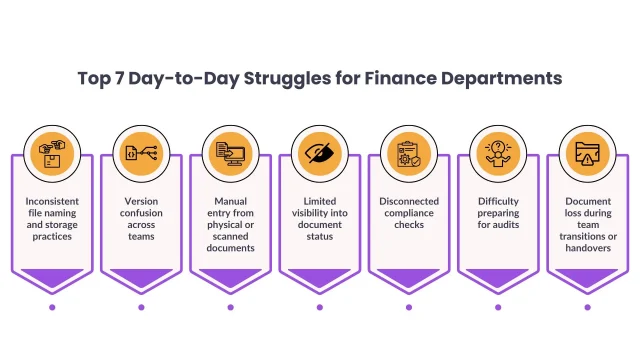

Here are the 7 everyday challenges finance teams face:

- Inconsistent file naming and storage practices

Finance documents often end up saved with inconsistent names across shared drives, personal folders, or email threads. This makes retrieval difficult and introduces delays when files are urgently needed for audits, payments, or reconciliations. - Version confusion across teams

Multiple versions of the same document spread over emails, desktops, and cloud folders create confusion. Finance teams waste time verifying which version is final, leading to reporting errors and missed deadlines. - Manual entry from physical or scanned documents

Invoices, tax documents, and receipts still arrive in varied formats, including handwritten or scanned PDFs. Manually entering this information is time consuming and increases the risk of human error. - Limited visibility into document status

When there’s no clear tracking system, it’s hard to know whether a file has been received, reviewed, or is still pending. This causes follow-ups to pile up, slowing month-end closures and vendor payments. - Disconnected compliance checks

Finance teams often perform document validations in isolation, without integration into core systems. As a result, identifying missing or non- compliant documents becomes a repetitive, error-prone task. - Difficulty preparing for audits

When files are scattered or incomplete, audit preparation becomes a scramble. Gathering proof of payment, authorizations, and historical records requires hours of manual effort. - Document loss during team transitions or handovers

With changes in staffing or department restructuring, critical documents can get lost or left behind. Lack of a central, secure repository leads to gaps that show up only during reviews or escalations.

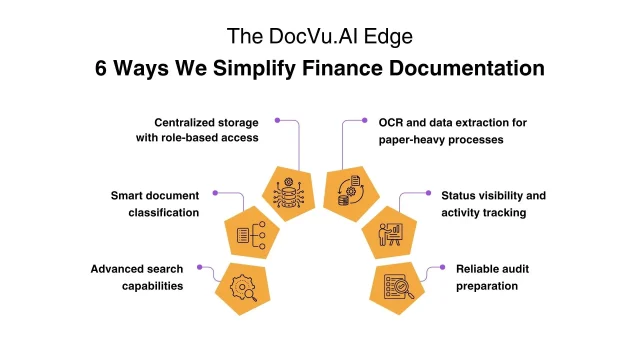

The DocVu.AI Edge

DocVu.AI addresses common finance documentation issues with features built for clarity, speed, and control. Here’s how:

- Centralized storage with role-based access

DocVu.AI offers a secure, cloud-based platform that centralizes the storage of financial documents, including invoices, receipts, tax records, contracts, and audit files. Role-based access controls ensure that team members have appropriate permissions, enhancing security and compliance. - Smart document classification

Leveraging AI and machine learning, DocVu.AI automatically classifies documents based on their content, reducing the need for manual tagging and ensuring accurate organization from the outset. Source - Advanced search capabilities

The platform enables users to search for documents using keywords, document types, vendor names, or date ranges. This functionality streamlines document retrieval and minimizes time spent navigating complex folder structures. - OCR and data extraction for paper-heavy processes

DocVu.AI utilizes Optical Character Recognition (OCR) and data extraction technologies to accurately process scanned and handwritten documents, including invoices and receipts. This automation reduces manual data entry and associated errors. - Status visibility and activity tracking

Every action taken on a document within DocVu.AI is logged, providing comprehensive audit trails. This transparency facilitates monitoring document statuses and enhances accountability during financial operations. - Reliable audit preparation

With centralized storage, intelligent classification, and detailed activity logs, DocVu.AI simplifies audit preparation. Finance teams can efficiently generate audit-ready reports, ensuring compliance and reducing the time spent on manual document compilation.

Conclusion

Managing financial documents doesn’t have to be a constant source of friction. With the right systems in place, finance teams can reduce errors, save time, and stay ready for whatever review or request comes next. DocVu.AI isn’t about adding more tools, it’s about making document handling easier, clearer, and more reliable for the teams that need it most.