Introduction

In today’s mortgage landscape, document management is no longer a backend function. It directly impacts loan quality, compliance integrity, and processing speed. Yet, many lenders remain tied to outdated, rigid systems that can no longer meet the pace or complexity of modern mortgage operations.

With rising borrower expectations, evolving compliance standards, and tighter turn times, lenders are now asking a critical question: Is my document management system delivering measurable ROI in mortgage?

This blog offers a clear comparison between a traditional DMS and a next generation AI-powered document management system, and why the time for lenders to upgrade is now. Understanding the long-term operational and financial benefits of switching is crucial for lenders who aim to maintain a competitive edge.

Legacy DMS in Mortgage: Where the Gaps Lie

Legacy Document Management Systems (DMS) were designed during a time when mortgage processes were more static, and digital transformation was in its infancy. These systems focus on storing files, not enabling processes.

Key limitations include:

- Manual indexing and sorting: Processors spend hours renaming, tagging, and uploading.

- No intelligent search or audit logs: Retrieving documents or tracing versions is cumbersome.

- Poor adaptability to compliance updates: New investor or regulatory guidelines require manual patches or workarounds.

- Limited system interoperability: Most cannot integrate with modern Loan Origination Systems (LOS), post close review tools, or audit platforms.

The result? Slower workflows, increased labor costs, and greater exposure to investor conditions and repurchase risks.

What an AI-Powered Mortgage Document Management System Offers

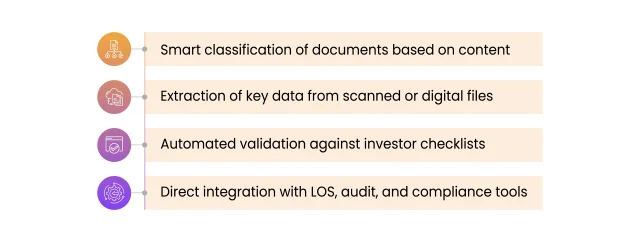

Modern platforms like DocVu.AI are designed to meet the dynamic needs of mortgage operations. Instead of just a basic document management, that they offer:

- Smart classification of documents based on content

DocVu.AI automatically identifies and classifies documents using AI, based on their actual content. This eliminates manual sorting and ensures consistent file organization across all loan files. - Extraction of key data from scanned or digital files

The platform uses intelligent OCR to extract key data from scanned documents, images, and PDFs. This speeds up data capture, improves accuracy, and removes the need for manual entry. - Automated validation against investor checklists

DocVu.AI checks every document against relevant investor guidelines in real- time. This helps avoid missing documents, reduces conditions, and ensures loan packages are delivery-ready. - Direct integration with LOS, audit, and compliance tools

It integrates directly with your LOS and compliance systems, enabling seamless data sync. This removes redundant steps and ensures every department accesses real time, validated information.

ROI in Mortgage: Comparing Outcomes

Let’s evaluate where value is gained with an AI-powered document management system:

- Processing Time & Labor Efficiency

Legacy systems slow teams down. When processors spend hours renaming and filing, loan cycles drag. With intelligent tools handling classification and data pull, teams focus on exceptions not admin work. This has led to processing time improvements as high as 30%, without increasing headcount. - Investor & Regulatory Compliance

Missing audit trails, outdated forms, or version conflicts lead to failed reviews. Lenders using modern systems report significantly fewer investor conditions or repurchase requests. Why? Because mortgage compliance checks are embedded into the document lifecycle itself. - Audit Readiness

Traditional setups often require “audit prep” phases. With AI-based systems, each document has a traceable owner, timestamp, and data match. Audit readiness becomes continuous not an afterthought. - Faster Loan Funding

When document packages are complete, verified, and compliant earlier, funding happens sooner. This accelerates revenue realization and improves investor relationships. - Cost of Operations

Legacy systems demand costly maintenance and third-party involvement. AI platforms operate with fewer manual inputs and lower long-term maintenance requirements, resulting in a more scalable, cost effective foundation.

Why Lenders Are Switching to DocVu.AI

The shift toward intelligent document management is not just about automation, it is about performance, accountability, and speed. In 2025, competitive lenders can’t afford to rely on systems that were never built for the digital mortgage era.

DocVu.AI enables:

- Automated capture and categorization of all loan documents

- Live reconciliation between LOS data and document content

- Constant mortgage compliance alignment

- ROI in mortgage operations from day one

It is more than a mortgage document management system it is an intelligent layer that brings control, speed, and trust to every loan file.

The big question: AI vs. Legacy DMS: Which One Delivers Better ROI in Mortgage?

When comparing legacy and AI-driven document management systems, the difference in return on investment is clear. Legacy DMS tools were built for storage and basic retrieval, offering limited support for compliance, integrations, or workflow efficiency. They rely heavily on manual labor, which increases operating costs and slows loan cycle times.

In contrast, an AI-powered document management system like DocVu.AI transforms the way mortgage teams work. It automates document capture, eliminates manual indexing, ensures ongoing compliance alignment, and integrates directly with LOS and audit platforms. These capabilities lead to faster processing, reduced repurchase risk, and lower long-term operational costs delivering measurable ROI in mortgage operations from the start.

For lenders evaluating both options, the answer is no longer just about digital access. It’s about enabling speed, accuracy, and scale. And in that comparison, the mortgage document management system powered by AI clearly delivers more value.

Conclusion

Legacy systems were not built for today’s mortgage world. They struggle to keep up with the speed, scale, and regulatory complexity of the modern lending environment.

If your team is still relying on a DMS that was designed for static workflows, it may be costing more than just time it could be impacting your bottom line, compliance posture, and borrower experience.

A modern AI-powered document management system like DocVu.AI delivers tangible ROI in mortgage operations by reducing friction, improving audit outcomes, and speeding up funding cycles.

For lenders looking to increase operational efficiency while lowering risk, the shift is not just recommended it’s required.

Ready to transform your mortgage operations?

Schedule a free demo of DocVu.AI and discover how intelligent document management can deliver ROI from day one.

Frequently Asked Questions

A legacy DMS focuses on static storage and manual processes, while an AI- powered document management system like DocVu.AI automates classification, data extraction, and compliance validation—resulting in faster, more accurate, and scalable mortgage operations.

By reducing manual labor, improving processing speed, and ensuring compliance alignment, an AI-powered mortgage document management system helps lenders lower operating costs and avoid repurchase risks—driving measurable ROI in mortgage operations.

Yes. DocVu.AI offers seamless integration with modern LOS platforms and audit tools, enabling real-time data sync and eliminating duplicate data entry across your mortgage document management system.

Legacy systems cannot meet the speed, compliance, or integration demands of today’s lending environment. Lenders are switching to AI-powered document management systems to improve efficiency, reduce risk, and stay competitive in a digital first mortgage industry.