Introduction

In today’s lending landscape, post-close document accuracy isn’t just a compliance issue, it’s a business-critical requirement. As origination volumes fluctuate and investor demands tighten, mortgage lenders are pressured to deliver complete, audit-ready files faster and more precisely. Yet for many, document management remains fragmented, manual, and error-prone.

DocVu.AI offers a modern response to this challenge. Designed specifically for mortgage operations, it combines intelligent document processing (IDP), automated data validation, and system level integration to reduce risk, accelerate loan delivery, and support investor compliance without adding complexity or overhead.

The Document Burden in Mortgage Operations

Each mortgage loan file can span hundreds of pages and include more than 250 document types ranging from borrower disclosures and income verifications to closing instructions and title reports. The variety and volume of these documents introduce risk across multiple stages:

- Unstandardized formats from brokers and correspondents

- Disjointed storage between LOS, servicing, and third-party platforms

- Manual quality control (QC) checks are performed at the field level

- Trailing document issues that delay funding or delivery

These challenges are amplified at scale. When loan pipelines increase, manual processes fail to keep pace, resulting in delivery delays, compliance exposure, and reputational risk with investors.

Key Features of DocVu.AI for Mortgage Lenders

DocVu.AI helps lenders close this gap by introducing automation into document intensive parts of the mortgage lifecycle. It doesn’t replace existing systems, it enhances them with intelligent infrastructure that handles documentation with the same rigor as underwriting.

Here’s how DocVu.AI supports mortgage teams:

- Automatically classifies loan documents based on naming patterns and document content

- Extracts borrower, property, and transaction-level details without manual input

- Reconciles document data with LOS records to detect mismatches

- Flag incomplete or non compliant files before investor delivery

- Generates audit-ready delivery packages with embedded tracking

Post-Close Audits: Built for Accuracy at Scale

Post-close QC is one of the most resource-heavy phases in the lending process. Lenders must validate that each loan meets internal standards as well as investor or GSE-specific guidelines (such as those from Fannie Mae or Freddie Mac). Traditional approaches rely on sampling, spreadsheets, and email-based back-and-forth to resolve exceptions.

DocVu.AI redefines this process by making document validation continuous and system-driven. Instead of checking files manually days or weeks after closing, lenders can verify them in real time at the point of ingestion.

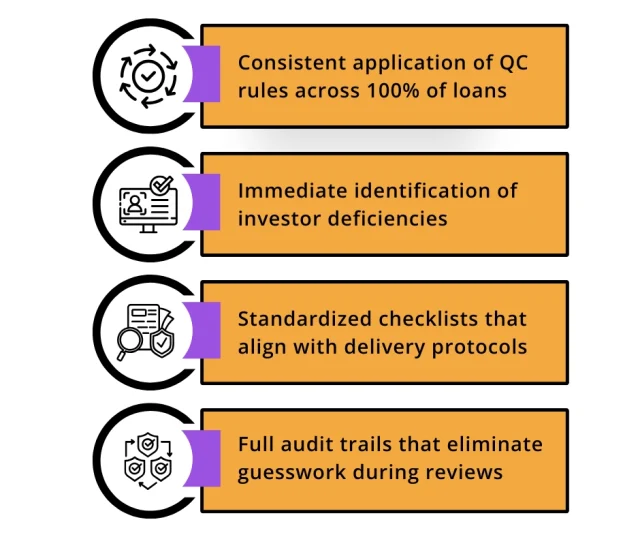

Benefits include:

- Consistent application of QC rules across 100% of loans

- Immediate identification of investor deficiencies

- Standardized checklists that align with delivery protocols

- Full audit trails that eliminate guesswork during reviews

This reduces the burden on QC staff and improves first-pass delivery rates to secondary market investors.

Investor Delivery Readiness Without Manual Assembly

Lenders often face bottlenecks in preparing loan files for investor submission. Incomplete packages, inconsistent naming, or outdated documents can stall funding and create compliance issues. DocVu.AI addresses this by ensuring that every document is verified, versioned, and filed correctly before delivery.

Its document stacking engine supports:

-

Fannie Mae and Freddie Mac delivery structures

-

Custom stacking for private investors or warehouse banks

-

Delivery packages in PDF, XML, or system integrated formats

This level of automation helps lenders avoid last-minute scrambles and accelerates time to funding – without compromising compliance.

LOS Integration and Document Traceability

DocVu.AI integrates directly with Loan Origination Systems (LOS), including Encompass, Empower, and custom in house platforms. Through these connections, it not only validates document data but also writes back verified outputs, status flags, and exception reports into the lender’s workflow.

This delivers:

-

End-to-end document visibility across systems

-

Fewer handoffs between teams (closing, funding, shipping)

-

Reliable audit logs tied to every action or update

-

Centralized exception reporting that supports rapid resolution

Mortgage teams no longer need to toggle between systems or manually reconcile files. Everything flows through one automated pipeline, governed by rules that lenders control.

Tackling Trailing Documents and Custodial Gaps

Trailing documents like recorded deeds, title policies, and lien releases often fall through the cracks after closing. Delays in retrieving or reviewing these documents increase investor risk and servicing costs. DocVu.AI monitors trailing document activity and validates each incoming record against loan level requirements.

Lenders can:

-

Track outstanding documents and request statuses in real time

-

Validate incoming files against document conditions

-

Set alerts for missing or stale documents based on delivery SLAs

By automating this part of the process, lenders avoid costly follow-ups and reduce the risk of non-compliant collateral files.

Impact Across the Mortgage Ecosystem

Lenders using DocVu.AI have reported measurable gains in operational

efficiency and compliance assurance. These include:

-

30–40% reduction in manual post-close QC labor

-

Higher investor acceptance rates with fewer delivery defects

-

Shorter funding cycles by up to 2 days per loan

-

Lower repurchase exposure due to early exception resolution

The value lies not just in automation, but in how intelligently it adapts to each lender’s process, investor base, and compliance strategy.

A Scalable Approach to Mortgage Documentation

What sets DocVu.AI apart is its focus on adaptability. Whether a lender is managing 500 loans a month or 50,000, the platform adjusts to workload and delivery protocols without adding complexity. Rules can be configured by investor, loan program, or branch. Teams can access exception dashboards, audit history, and performance insights at the loan-level or portfolio-level scale.

This flexibility ensures that automation doesn’t just replace tasks—it improves the structure and visibility of the entire post-close ecosystem.

Conclusion: A Smarter Model for Mortgage Documentation

In 2025, mortgage success isn’t just about closing loans—it’s about delivering clean, compliant, and audit-ready files at scale. The industry can’t afford to rely on spreadsheets, shared drives, or after-the-fact corrections. DocVu.AI gives lenders the infrastructure to move faster, with more control, and with fewer downstream risks.

Explore how DocVu.AI can strengthen your post-close operations at www.docvu.ai