Reinvent

process transformations

Elevate Your Business with AI & ML-Powered

Intelligent Document Processing.

FEATURES

A single platform for your end to end transformation

In today’s ever-evolving digital landscape, businesses must adapt and transform to stay competitive. At DocVu.AI, we understand the challenges and opportunities presented by technology transformation. That’s why we’ve harnessed the power of AI & ML to lead your business into a new era of innovation and efficiency.

Generative AI is a game-changer, and at DocVu.AI, we’ve made it the cornerstone of our technology transformation solutions. The technology powers the solution to understand new document templates quickly, create synthetic data, enable underwriting automations, enable decision making capabilities and automate notification triggers.

Definable business rules engine to manage tasks and events drive workflows in the mortgage industry. Auto trigger of events based on business rules in document processing operations ensures faster mortgage analysis. Integrate DocVu.AI with your existing system seamlessly and configure your workflow engines according to business needs to improve document processing efficiency and improve data flow without any changes to your working procedures through auto team assignment based on tasks lead and rules.

Computer vision technology enables DocVu.AI to interpret and understand visual data with high accuracy. Computer vision mostly helps in preprocessing (identifying defects, stains etc) or layout analysis (identifying headers, footers or tables) or handwritten text recognition. This helps DocVu.AI in delivering higher accuracies in enterprise document processing.

Cognitive computing combines various AI techniques to mimic human thought processes. DocVu.AI use cognitive computing to improve problem-solving, reasoning, and decision-making. Cognitive systems can understand context, handle unstructured data, and provide insights beyond what traditional automation can achieve.

Natural Language Processing (NLP) allows DocVu.AI to understand and interpret human language within documents. NLP techniques are used for tasks such as text extraction, sentiment analysis, entity recognition, and language translation.

ML algorithms are employed for pattern recognition and data extraction. DocVu.AI is trained to identify specific data points, such as names, dates, invoice numbers, or purchase orders, within documents. ML models continuously learn and improve accuracy over time.

DocVu.AI rely on data integration and APIs to connect with external systems, databases, and cloud services. This allows for data exchange and seamless interaction with various software applications and platforms.

Process orchestration is a critical component of DocVu.AI, allowing the solution to sequence and coordinate various tasks, actions, and bots in complex business processes. It ensures that automation flows smoothly and efficiently.

DocVu.AI can recognize and validate patterns and templates within documents. This is particularly useful in scenarios where documents follow standard formats, such as invoices, contracts, or receipts.

DocVu.AI provides insights into document processing performance, error rates, and data quality etc. These metrics can help organizations optimize their document processes and identify areas for improvement.

It helps break down complex documents into structured data, making it easier to analyze and use for downstream processes. This includes separating header, footer, and line-item information in invoices etc.

Benefits

Automate Document Processing with DocVu.AI

Maximize productivity and efficiency in documents using the Intelligent Document Processing by DocVu.AI.

DocVu.AI automates document capture, sorting, and classification, reducing the need for manual data entry and processing.

Faster Data Extraction:

The solution quickly extracts key data from documents, such as invoices, receipts, contracts, and forms, streamlining workflows and saving time.

By eliminating manual data entry, DocVu.AI minimizes the risk of errors associated with manual document processing.

Data Validation:

The system validates extracted data against predefined criteria, ensuring accuracy and data quality.

With automation, organizations can significantly reduce labor costs associated with manual document handling and data entry.

Lower Error-Related Expenses:

Fewer errors mean fewer costs associated with error correction, reprocessing, and compliance issues.

DocVu.AI helps organizations adhere to regulatory requirements by accurately processing documents and maintaining detailed audit trails.

Data Privacy:

The solution includes security features to protect sensitive document data and maintain data privacy.

Automated document workflows through STPs accelerate the processing of documents, reducing bottlenecks and delays.

Integration Capabilities:

DocVu.AI integrates seamlessly with other systems and applications, allowing for end-to-end process automation.

DocVu.AI can handle a wide range of document types and formats, making it suitable for various industries and use cases.

Scalability:

The solution can scale to accommodate growing document volumes and organizational needs.

DocVu.AI provides valuable insights into document processing performance, allowing organizations to identify trends, bottlenecks, and areas for improvement.

Data Analytics:

Analytics features enable data-driven decision-making and process optimization.

DocVu.AI's indexing and metadata capabilities make it easy to locate and retrieve specific documents, reducing search times.

Searchable Content:

Transformed documents become searchable, enhancing document management and accessibility.

Increase Efficiency

DocVu.AI automates document capture, sorting, and classification, reducing the need for manual data entry and processing.

Faster Data Extraction:

The solution quickly extracts key data from documents, such as invoices, receipts, contracts, and forms, etc.

Improved Accuracy

By eliminating manual data entry, DocVu.AI minimizes the risk of errors associated with manual document processing.

Data Validation:

The system validates extracted data against predefined criteria, ensuring accuracy and data quality.

Cost Savings

With automation, organizations can significantly reduce labor costs associated with manual document handling and data entry.

Lower Error-Related Expenses:

Fewer errors mean fewer costs associated with error correction, reprocessing, and compliance issues.

Enhanced Compliance

DocVu.AI helps organizations adhere to regulatory requirements by accurately processing documents and maintaining detailed audit trails.

Data Privacy:

The solution includes security features to protect sensitive document data and maintain data privacy.

Streamlined Workflow

Automated document workflows through STPs accelerate the processing of documents, reducing bottlenecks and delays.

Integration Capabilities:

DocVu.AI integrates seamlessly with other systems and applications, allowing for end-to-end process automation.

Scalability and Flexibility

DocVu.AI can handle a wide range of document types and formats, making it suitable for various industries and use cases.

Scalability:

The solution can scale to accommodate growing document volumes and organizational needs.

Data Insights

DocVu.AI provides valuable insights into document processing performance, allowing organizations to identify trends, bottlenecks, and areas for improvement.

Data Analytics:

Analytics features enable data-driven decision-making and process

optimization.

Enhanced Customer Experience

Organizations can respond to customer inquiries and requests more quickly due to faster document processing.

Personalization:

The system can extract customer-related data for personalized interactions and services.

Document Retrieval and Search

DocVu.AI's indexing and metadata capabilities make it easy to locate and retrieve specific documents, reducing search times.

Searchable Content:

Transformed documents become searchable, enhancing document management and accessibility.

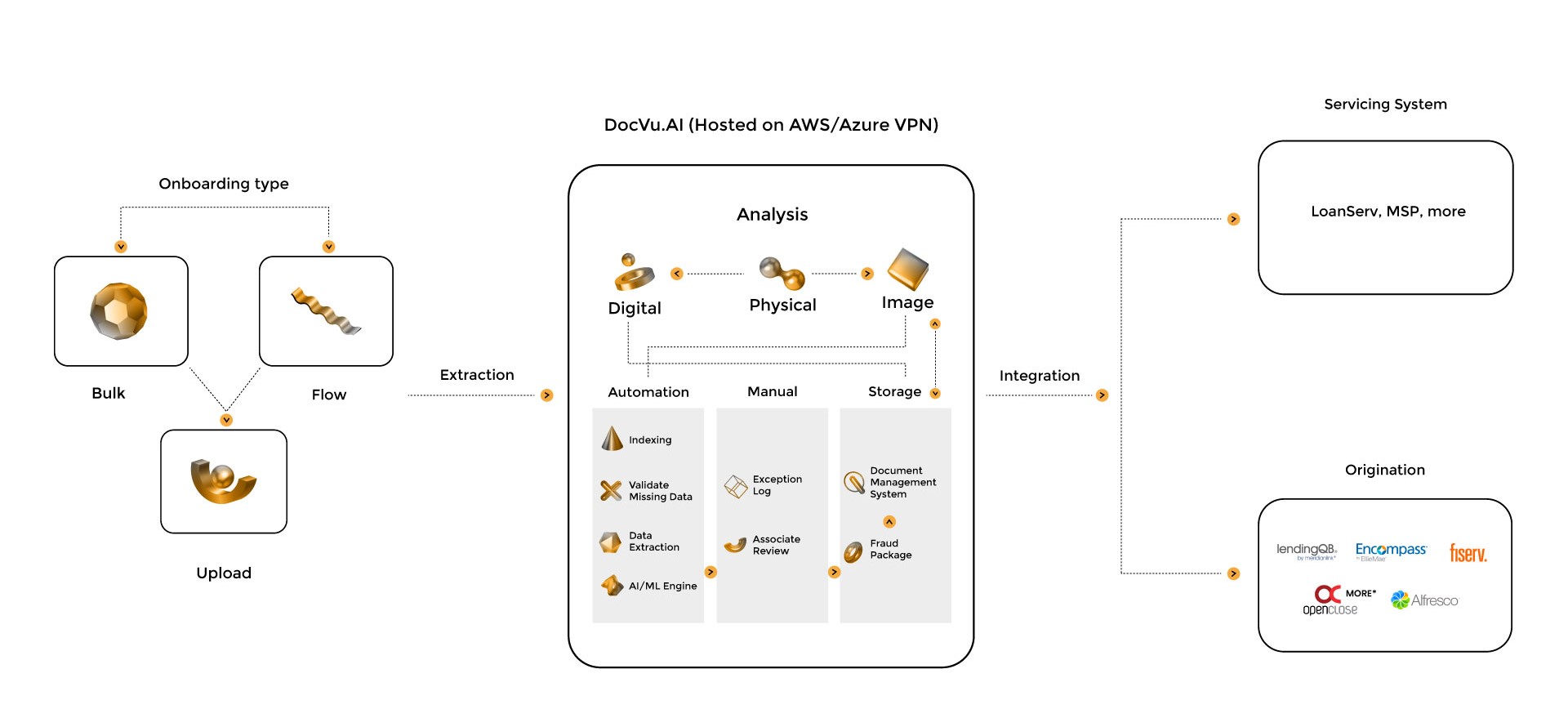

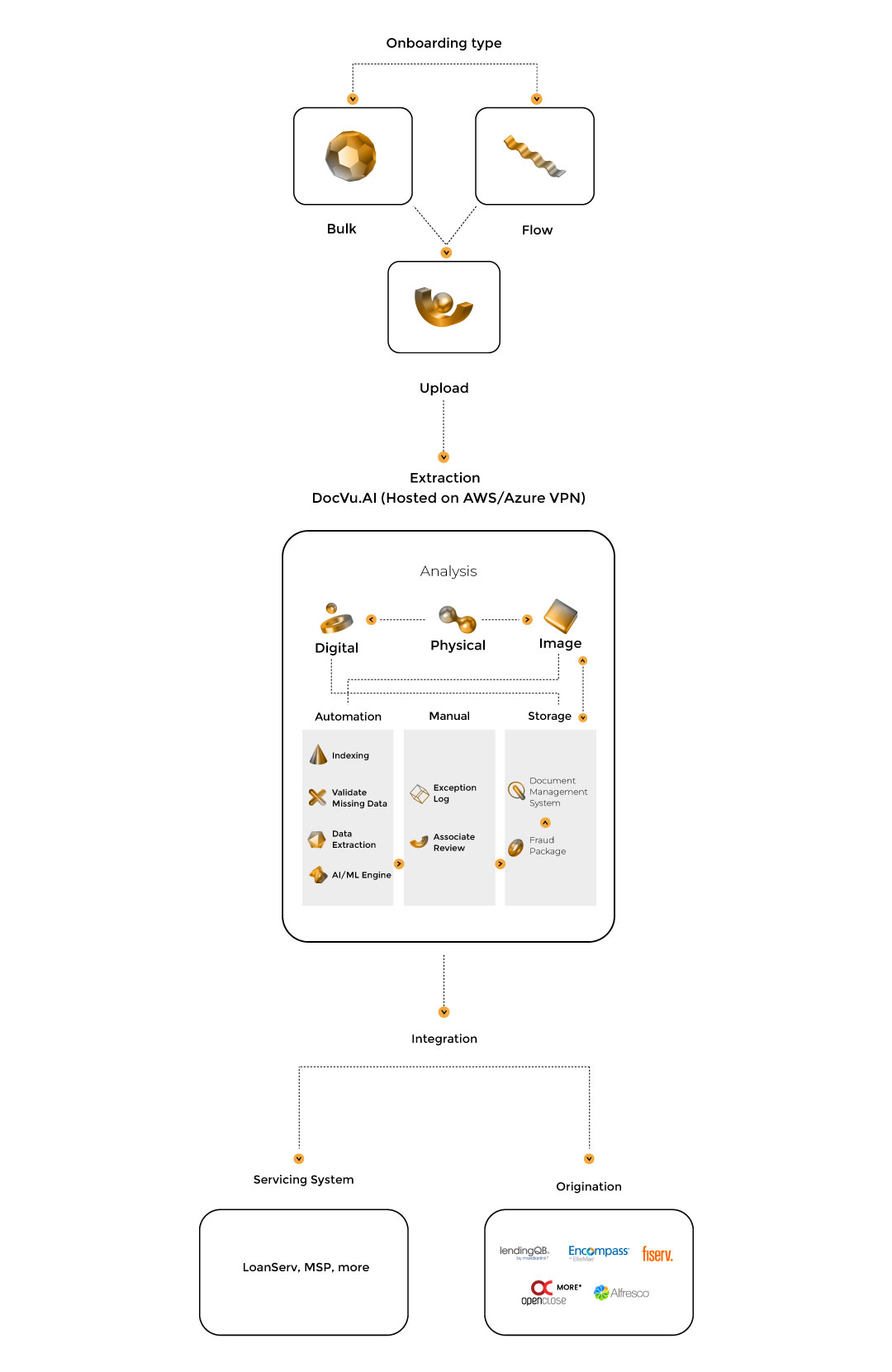

End-to-End Automated Intelligent Document Processing Workflow

Automate document processing with DocVu.AI

Manage your documents better and improve your data extraction efficiency.

Integrating DocVu.AI

- Loan Originations System Integrations

Initiate and offer document processing solutions with improved accuracy and faster turnaround time.

- Document Management Systems Integration

Enables end-to-end document management and offers better control by integrating with Alfresco document management system.

- ERP

Go paperless and automate the information flow among all your teams to improve productivity and flexibility while reducing operational expenses with ease.

- Custom Systems Integration

Makes your existing processing system more efficient and accurate with easy integration.

Partner With Us

Leverage DocVu.AI to make your document processing faster and more accurate. Get in touch with us!

Frequently Asked Questions

Document processing improves business performance and operational agility by optimizing core processes. Documenting processes during execution enables employees to learn by doing, gaining insights from mistakes and successes to refine processes.

When selecting an Intelligent Document Processing (IDP) solution for your business, consider the following factors:

- Accuracy and reliability of the solution’s machine learning algorithms

- Flexibility and configurability to adapt to your specific document types and workflows

- Integration capabilities with existing systems

- Scalability to handle your document volumes

- Security measures to protect sensitive data

- Vendor support and reputation

- Cost-effectiveness and return on investment.

Evaluate multiple solutions, conduct proofs-of-concept, and involve key stakeholders to ensure the selected IDP solution aligns with your business needs and goals.